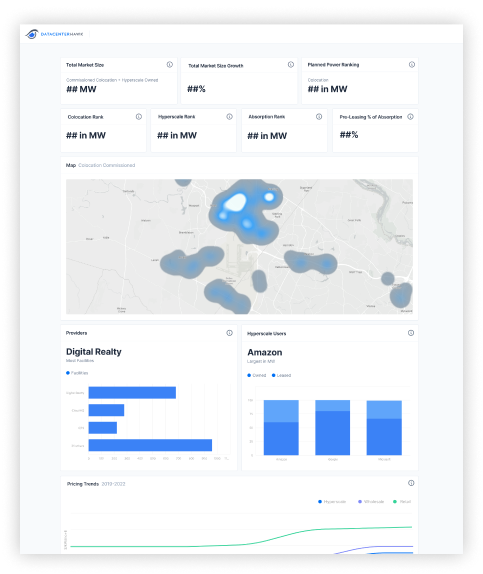

Data center real estate market in North America

Houston

Published one week ago

11th

In supply of data center real estate, measured by commissioned power

20th

In demand for data center real estate, measured by TTM absorption

6th

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Houston

Five years ago, the Houston data center market looked dramatically different. Made up of mostly enterprise data center users at the time that owned and operated their own facilities, colocation users needing to be in Houston had to locate in either downtown or in one of the few colocation facilities located throughout the market. As the colocation market matured and Houston’s economy grew, data center operators delivered quality facilities and solutions to meet the demand.

Areas like Greenspoint, The Woodlands, and Katy have been recipients of the growth by major data center providers, including Digital Realty, CyrusOne, Stream Data Centers, Skybox Datacenters, and Data Foundry. Data center users find the Houston market as an acceptable place to house their data because of the friendly business climate, the increased colocation/cloud competition, and the maturity of the colocation market.

Largest colocation providers

Measured by total commissioned power

Focused on Houston?

Get instant access to market analytics. Guess less. Make better decisions.