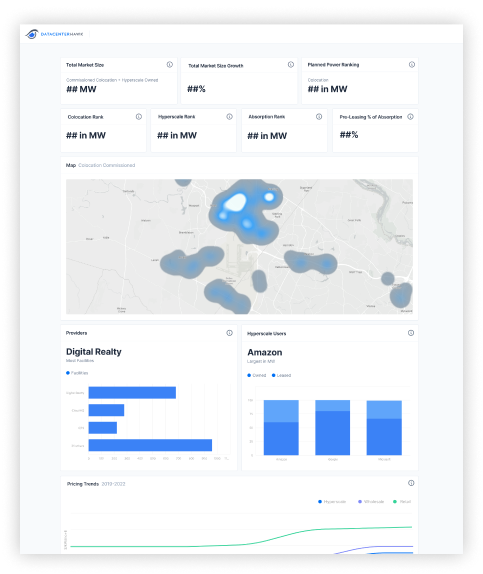

Data center real estate market in North America

Northern California

Published one week ago

24th

In supply of data center real estate, measured by commissioned power

10th

In demand for data center real estate, measured by TTM absorption

19th

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Northern California

Northern California, home to Silicon Valley, is one of the larger data center markets in the country. Most companies objectively evaluating the market for expansion should be deterred by the area's expensive real estate, power costs, and risk of earthquakes. Despite these facts, consistent activity from large data center users and colocation/cloud operators over the last five years is the prime catalyst for the market's size. Growth in the Northern California data center market has occurred in several cities south of San Francisco, with Santa Clara being home to the majority. Employment from technology companies makes up 28% of total employment in the Silicon Valley metro area according to the 2024 Silicon Valley Index released by Silicon Valley's Institute for Regional Studies. While the Northern California data center market benefits greatly from tech sector growth, it also heavily depends on it—posing a risk should the sector decline. Other industries consistently active and adding to the data center growth in Northern California include telecom, healthcare, financial, and retail.

Largest colocation providers

Measured by total commissioned power

Focused on Northern California?

Get instant access to market analytics. Guess less. Make better decisions.