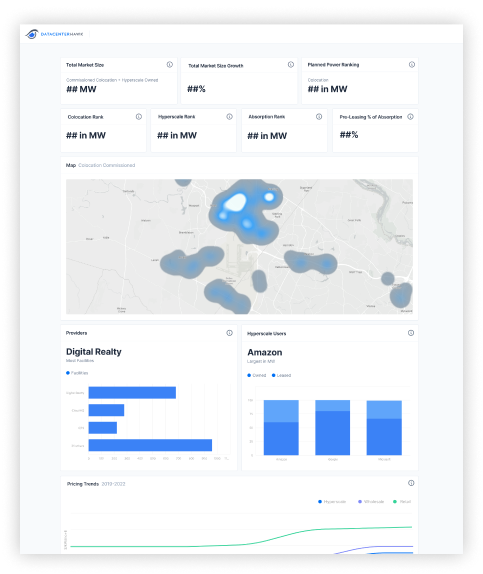

Data center real estate market in North America

Northern New Jersey

Published two months ago

17th

In supply of data center real estate, measured by commissioned power

3rd

In demand for data center real estate, measured by TTM absorption

3rd

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Northern New Jersey

It's no surprise the Northern New Jersey data center market has grown over the past few years. Even with the threat of oversupply two years ago, the market has continued to see demand and activity from data center users and operators. The Northern New Jersey colocation market has grown considerably over the last few years due to proximity to New York City, robust infrastructure, and favorable business climate.

In 2008, the Northern New Jersey market was mostly data center users that built, owned, and operated their own enterprise data centers. The financial implosion of 2009 helped fuel the colocation market as data center providers scoured Northern New Jersey for sites and opportunities to offer solutions to these companies. Typical requirements in the Northern New Jersey market are above 1 MW, but certain companies entering the market will sometimes have requirements starting at 100 kW. Industries active in the Northern New Jersey market are financial, healthcare, media, and technology companies.

Largest colocation providers

Measured by total commissioned power

Focused on Northern New Jersey?

Get instant access to market analytics. Guess less. Make better decisions.