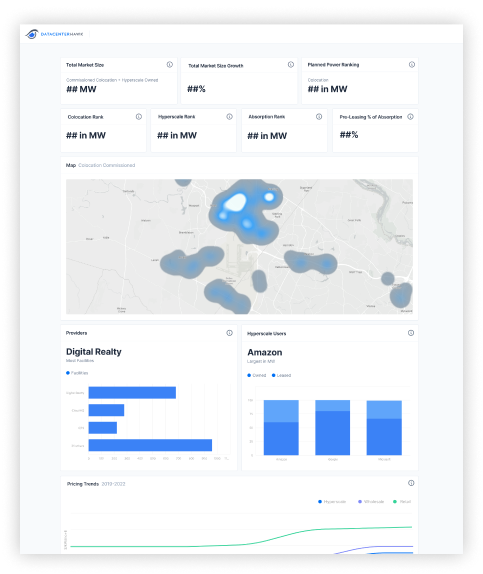

Data center real estate market in North America

Portland

Published one week ago

21st

In supply of data center real estate, measured by commissioned power

11th

In demand for data center real estate, measured by TTM absorption

9th

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Portland

Although Portland is considered a secondary data center market (especially compared to other West Coast markets like Silicon Valley), data center users increasingly find the market attractive. Portland's numerous advantages for data centers include the growing economy, the growing technology sector, the lower seismic threat, and aggressive tax incentives.

Referred to as the Silicon Forest, the recent investments in the area made by enterprise users and colocation providers are indicative of large-scale future growth for Portland. The main data center development has occurred in the Portland suburb, Hillsboro, where heavy investments from Intel have led to growing interest in the region. The recent colocation and data center development has been sparked by Infomart (now Stack Infrastructure) and Digital Realty’s data center construction in 2011-2012. Other providers, such as T5, Telx (now Digital Realty), and ViaWest (now Flexential) quickly saw the value in the market, leading to nearly 100 MW of commissioned power currently delivered to Portland.

Largest colocation providers

Measured by total commissioned power

Focused on Portland?

Get instant access to market analytics. Guess less. Make better decisions.