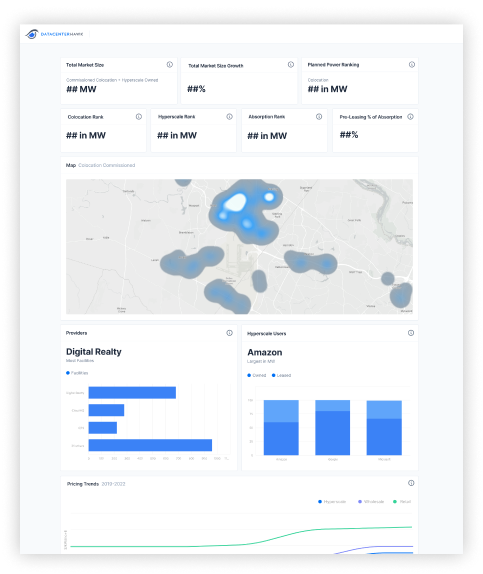

Data center real estate market in North America

Quincy

Published two months ago

17th

In supply of data center real estate, measured by commissioned power

22nd

In demand for data center real estate, measured by TTM absorption

5th

In hyperscale owned facilities, measured by operational power

Real estate supply pipeline

Rank amongst North America markets

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

Available

Colocation power commissioned and available within the market, measured in MW

Under Construction

Speculative colocation power under construction within the market, measured in MW

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Quincy

The Quincy Data Center Market is growing and its growth process reveals how the market has developed over the years. Historically, the presence of large enterprises in an area draws the attention of colocation providers to potential opportunities to serve those large corporations: this trend is distinctly playing out in Quincy.

Quincy was seen as an “enterprise” data center market for years, where companies like Dell, Microsoft, Intuit, and Yahoo built and owned their own data centers. Awakened to the allure of this new market, Sabey, Vantage Data Centers, CyrusOne, and H5 (more recently) began to test the waters, and each are currently active in the market. As these multi-facility campuses are delivered, the opportunity for growth is increases based on credible colocation options for larger data center users. From a geographic perspective, much of the data center development has occurred in the Northern half of the city and a city northwest of Quincy called Wenatchee.

Largest colocation providers

Measured by total commissioned power

Focused on Quincy?

Get instant access to market analytics. Guess less. Make better decisions.