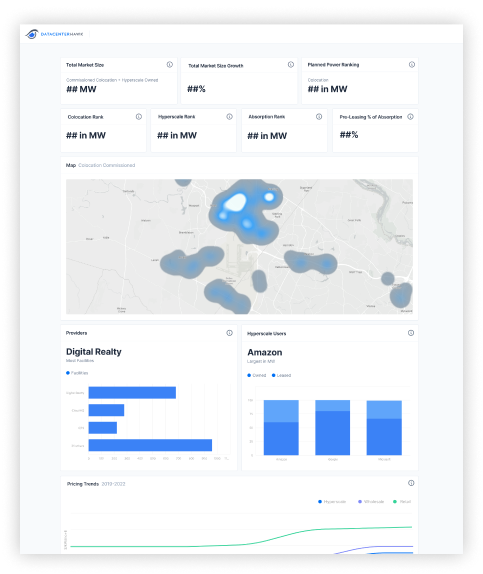

Data center real estate market in North America

Toronto

Published one week ago

17th

In supply of data center real estate, measured by commissioned power

26th

In demand for data center real estate, measured by TTM absorption

8th

In hyperscale owned facilities, measured by operational power

Access Analytics

Real estate supply pipeline

Rank amongst North America markets

17th

Commissioned

Colocation power commissioned within the market, measured in MW, includes preleasing

25th

Available

Colocation power commissioned and available within the market, measured in MW

14th

Under Construction

Speculative colocation power under construction within the market, measured in MW

10th

Planned

Speculative planned colocation power that hasn't yet broken ground, measured in MW

About Toronto

Toronto is a maturing data center market and grew as telecommunications companies began providing colocation to Canadian companies. These retrofit facilities and services were traditionally best suited for companies smaller infrastructure requirements, which is one of the reasons most Toronto infrastructure requirements remain under 250 kW. Many of the companies here with larger needs have kept their requirements in facilities the company owned and operated themselves. In recent years, however, data center providers serving larger customer needs have established a presence in Toronto (Digital Realty, Equinix, Urbacon, and several others). Both the purpose-built facilities and relationships with existing customers in other markets will drive larger demand to the Toronto area.

Largest colocation providers

Measured by total commissioned power

Access Analytics

Focused on Toronto?

Get instant access to market analytics. Guess less. Make better decisions.