By Luke Smith · 5/17/2020

Data center users like Phoenix because of its stable environment and land suitable for large data center developments. Power costs in Phoenix are also highly competitive, particularly in contrast with other West Coast markets. Tax incentives are available, as well, offering companies exemptions from state taxes on equipment and labor.

The Phoenix data center market characteristics are attractive to retail, enterprise and hyperscale users.

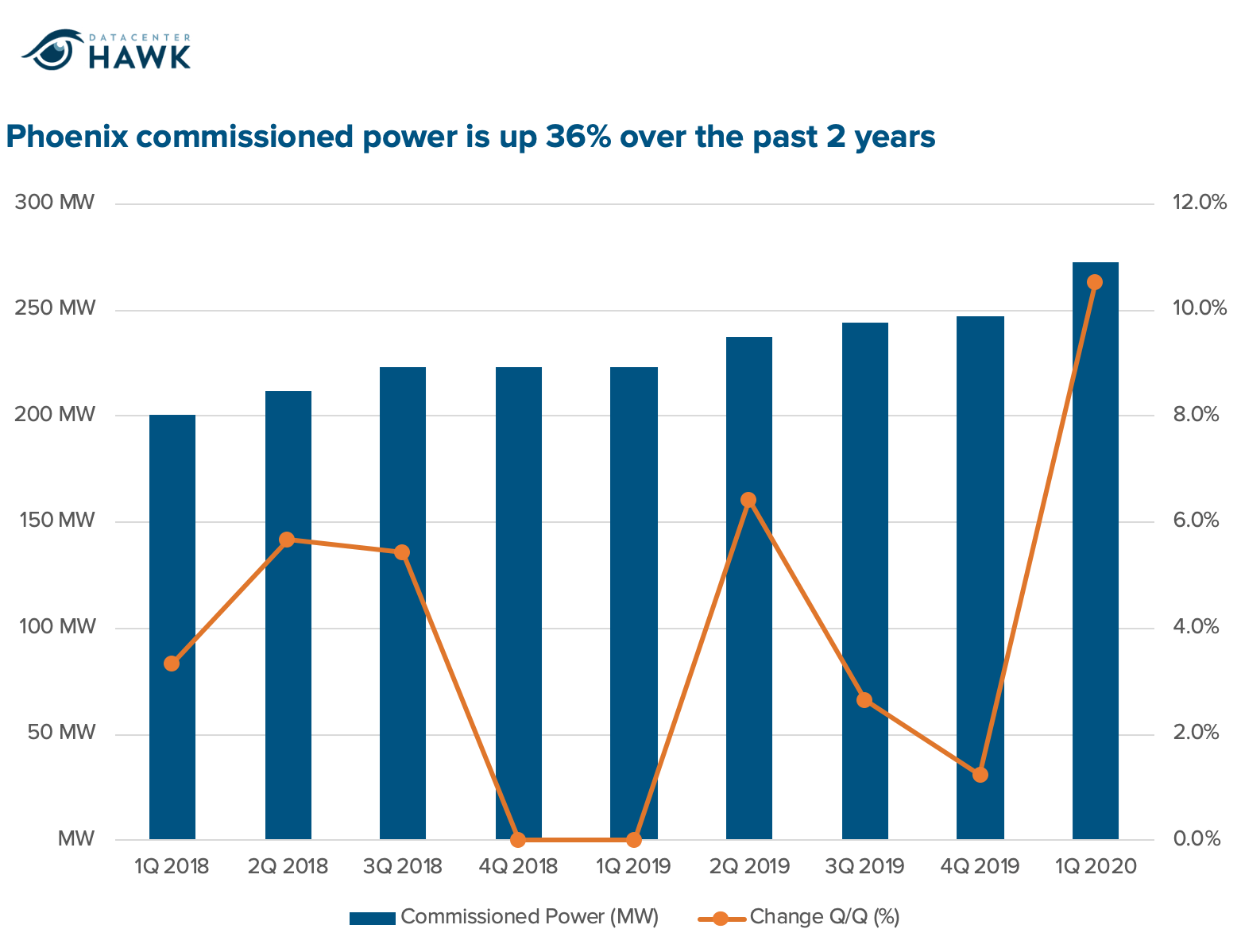

Phoenix commissioned power is up 36% over the past two years.

Phoenix commissioned power is up 36% over the past two years.Attractive Alternative to West Coast Markets

Phoenix originally gained attention as an alternative location for companies with a data center presence on the West Coast. The region’s connectivity and stable environment made it attractive for disaster recovery and storage.

Companies with larger requirements often value the economic savings a market like Phoenix provides when compared against other West coast locations.

Strong 1Q 2020 Indicates Healthy 2020

The Phoenix data center market started off 2020 strong, with over 24+ MW of absorption. The absorption is primarily attributed to several large transactions. Providers in Phoenix are also in active discussions for additional transactions of a similar size, which would deploy throughout 2020.

Drop in Vacancy

The vacancy rate dropped in Phoenix for the first time since 4Q 2018.

Strong leasing in 1Q 2020 halted the market’s vacancy rate rise, and continued absorption in 2020 will likely drop the rate below 10%.

Phoenix vacancy rates dropped for the first time since 4Q 2018

Phoenix vacancy rates dropped for the first time since 4Q 2018Get access to all of our Phoenix data and insights.

Tale of Two Cities

A significant amount of the new data center development in Phoenix is centered around the cities of Mesa and Goodyear. Companies like EdgeConneX, QTS, Digital Realty, CyrusOne, and NTT have plans to build large campuses in Mesa, while EdgeCore has already delivered capacity.

On the West side of Phoenix is the suburb of Goodyear, where Compass, Vantage, and Stream intend to deliver large campuses. Compass is under construction with the first shell at their 260 MW campus. Stream is also under construction with the first 4.5 MW of commissioned power at their retrofit warehouse shell.

Aligned Energy continues North Phoenix Expansion

Aligned operates one of the largest data centers in Phoenix and continues to grow their presence in the region. The company is currently expanding the facility, which is already partially pre-leased. Between under construction and planned capacity, Aligned has space available to double capacity in the future.

The data center features the Uptime Institute’s M&O Stamp of Approval and can accommodate high-density deployments of up to 50 kW per rack.

Cyxtera Active in Tempe

Cyxtera opened their third data center in Phoenix in 2Q 2019. The company has a presence inside Digital Realty’s 2055 East Technology Circle data center in Tempe. They recently announced the availability of NVIDIA DGX AI services, which enables Cyxtera users in the Tempe data center to use NVIDIA processors to handle AI workloads.

NTT to Develop Large Campus in Mesa

NTT purchased a 102-acre site in Mesa in 3Q 2019 where they plan to develop their first Phoenix data center campus. The seven-building, 1.5 million SF campus will offer up to 240 MW of commissioned power once fully delivered.

Other active Phoenix data center providers

Flexential, Iron Mountain, and H5 are also active in the Phoenix market with plans to expand existing data centers and build new data center campuses.

Get notified when we release our 2Q data

We’ll be keeping a close eye on Phoenix in 2020 to see if their strong 1Q performance will continue for the rest of the year. Sign up to be notified when our 2Q research is released. Don’t want to wait? Chat with us in the bottom right corner to get access to the full data, trends and history on Phoenix.