By Luke Smith · 11/30/2020

Northern Virginia is a leader among several markets that benefited due to heightened demand from digital transformation triggered by COVID and remote working.

Considering hyperscale transactions still evaluating the market, it’s likely Northern Virginia will exceed the market’s already lofty expectations.

2020 Northern Virginia Absorption Record Breaking

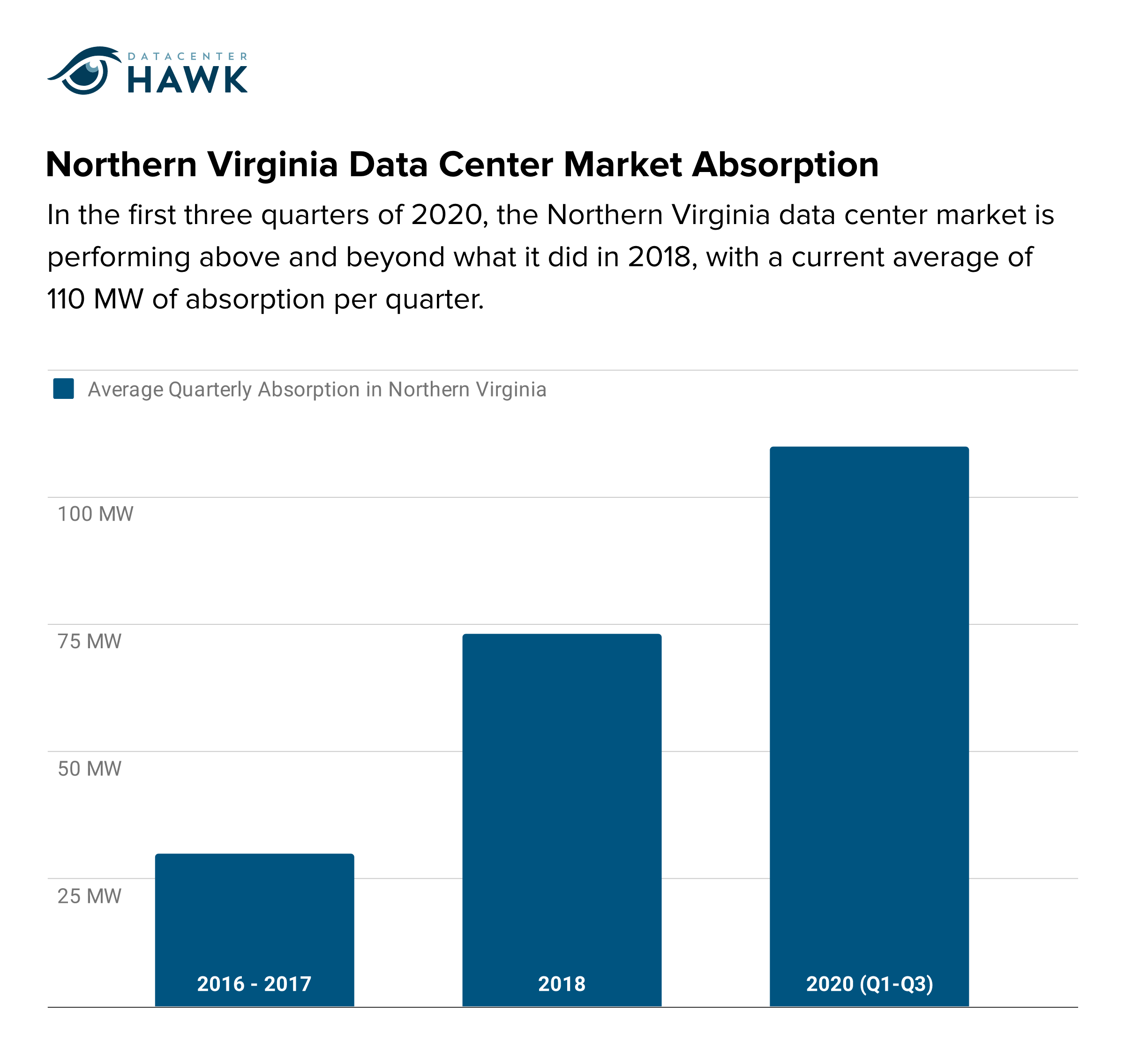

Northern Virginia has always been a strong market, averaging 30 MW of absorption per quarter until 2018, when the market experienced its strongest year, averaging 73 MW of absorption per quarter for the year.

This year, however, the market is performing above and beyond 2018, with a current average of 110 MW of absorption per quarter.

Northern Virginia Data Center Market Absorption

Hyperscale leasing is the primary driver behind this record-setting year, with many transactions taking place above 10 MW.

Growth in Loudoun and Prince William Counties

The epicenter of growth in Northern Virginia is Loudoun County, particularly in the towns of Ashburn and Sterling. These two areas are home to over 100 colocation and enterprise owned data centers.

This does, however, lead to a limited supply of land and high costs for the land that is available, causing some providers to look to the surrounding areas.

While other Loudoun County towns such as Reston or Leesburg receive some attention, the leading alternative is the Prince William County town of Manassas.

Is there risk in large scale Northern Virginia growth?

Despite the large-scale growth, Northern Virginia isn’t exempt from risks.

One risk factor to consider in markets with large data center development is demand changes that could negatively impact existing or under construction inventory.

After significant demand in 2018, 2019 absorption levels returned to their average of 33 MW per quarter, which led to an increased vacancy rate. If the pattern continues, it’s possible for this to happen again, although demand will likely remain steady through the next few quarters.

Another possible concern is churn, and second-generation capacity coming back online.

Northern Virginia customers have multiple leases across the market terminating in the next few years, and will likely look to consolidate those into one larger lease at a central location. This could leave providers with empty pockets of space that need to be filled.

Despite possible concerns, the Northern Virginia market remains the largest in the world and will continue to grow at a pace unseen in other American markets.

With other hyperscale deals evaluating the market and the lowest vacancy rate in the country, Northern Virginia shows no signs of slowing down in the near-future.