By Luke Smith · 4/6/2016

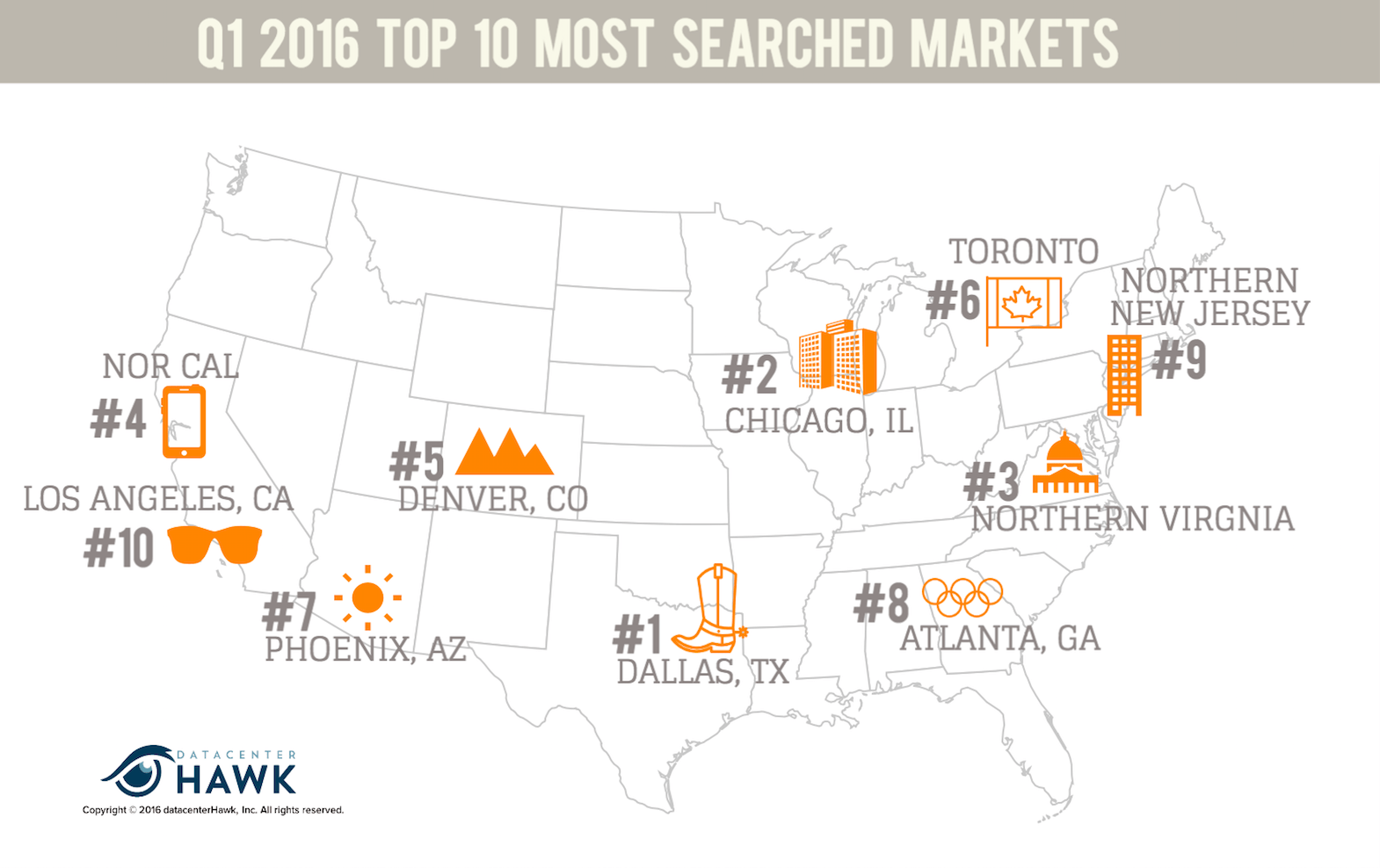

#1 Dallas – Supply on the way; DLR, CONE, QTS, Stream, Skybox, RagingWire, ViaWest and more; Dallas historically absorbs what’s delivered

#2 Chicago – Market now 190 MW of commissioned power; Large deals completed by DFT, DLR and others during the quarter

#3 Northern Virginia – The largest data center area keeps growing; DLR, DFT and Equinix with large presence – all growing

#4 Northern California – 16 MW transaction completed in Q1 by DFT (one of largest in industry history), and several others by large providers during the quarter

#5 Denver – Surprise Top 10 for some, but increasingly growing tech hub presence and well-educated workforce; Several providers active in the market as well

#6 Toronto - Many international companies look to Toronto as a strong IT city in the Americas with increased data privacy over the US

#7 Phoenix - Phoenix interest growing with providers like IO and Aligned Data Centers planning new facilities

#8 Atlanta – Favorable business climate and operator activity creating demand in Atlanta

#9 Northern New Jersey – Interesting this made the list as activity here generally slower; DFT working to sell NJ1 data center

#10 Los Angeles – LA data center growth slow but interest remains through search on datacenterHawk

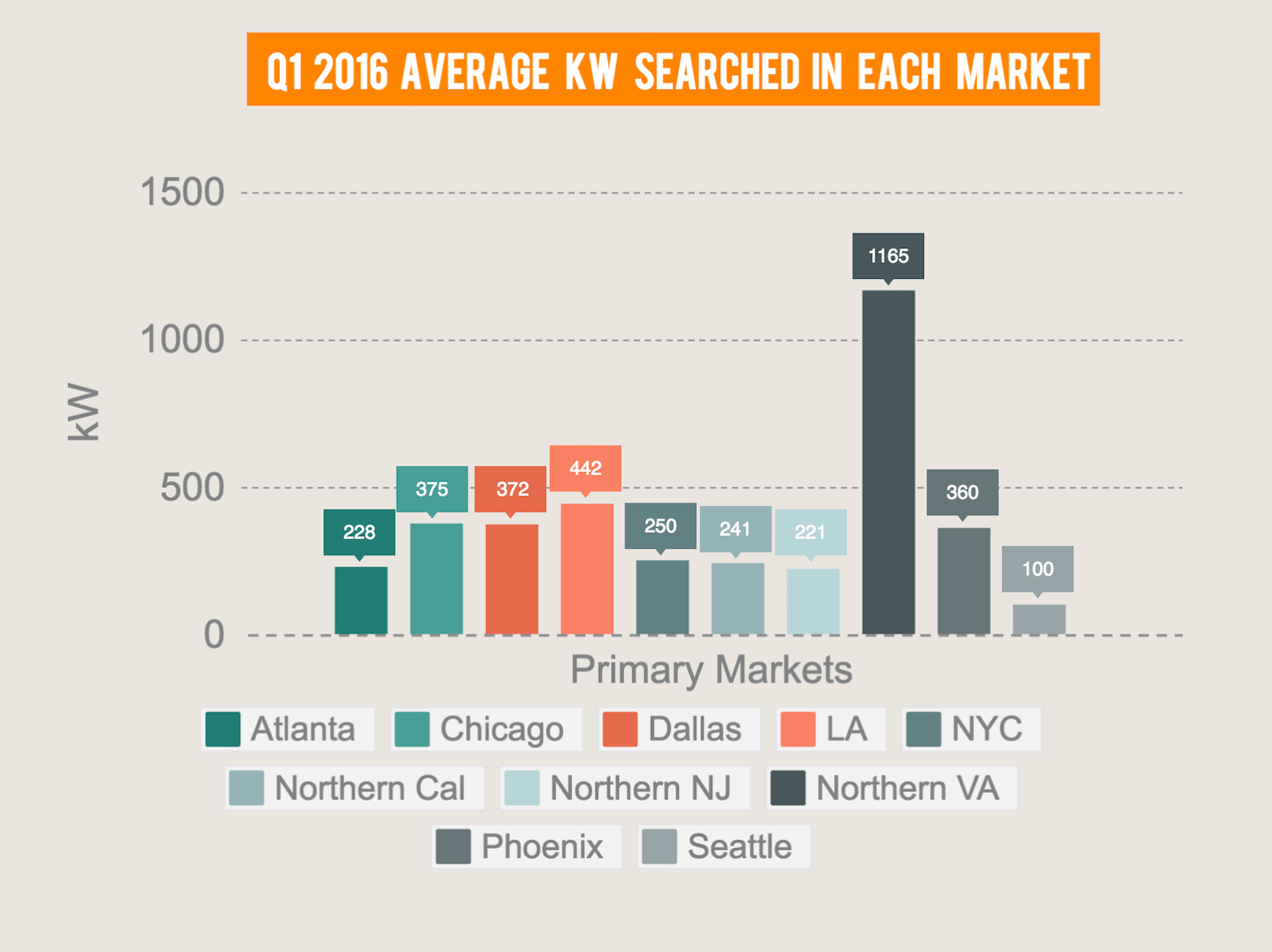

Northern Virginia leads the way with the largest sized requirements searched for Q1 2016. The area is the recipient of large data center requirements, as evidenced by the campus investments made by Digital Realty, DuPont Fabros, and Equinix in this market. It’s interesting to see all other markets leveled out between 100 and 450 kW. A popular size range as requirements grow smaller based on cloud options.

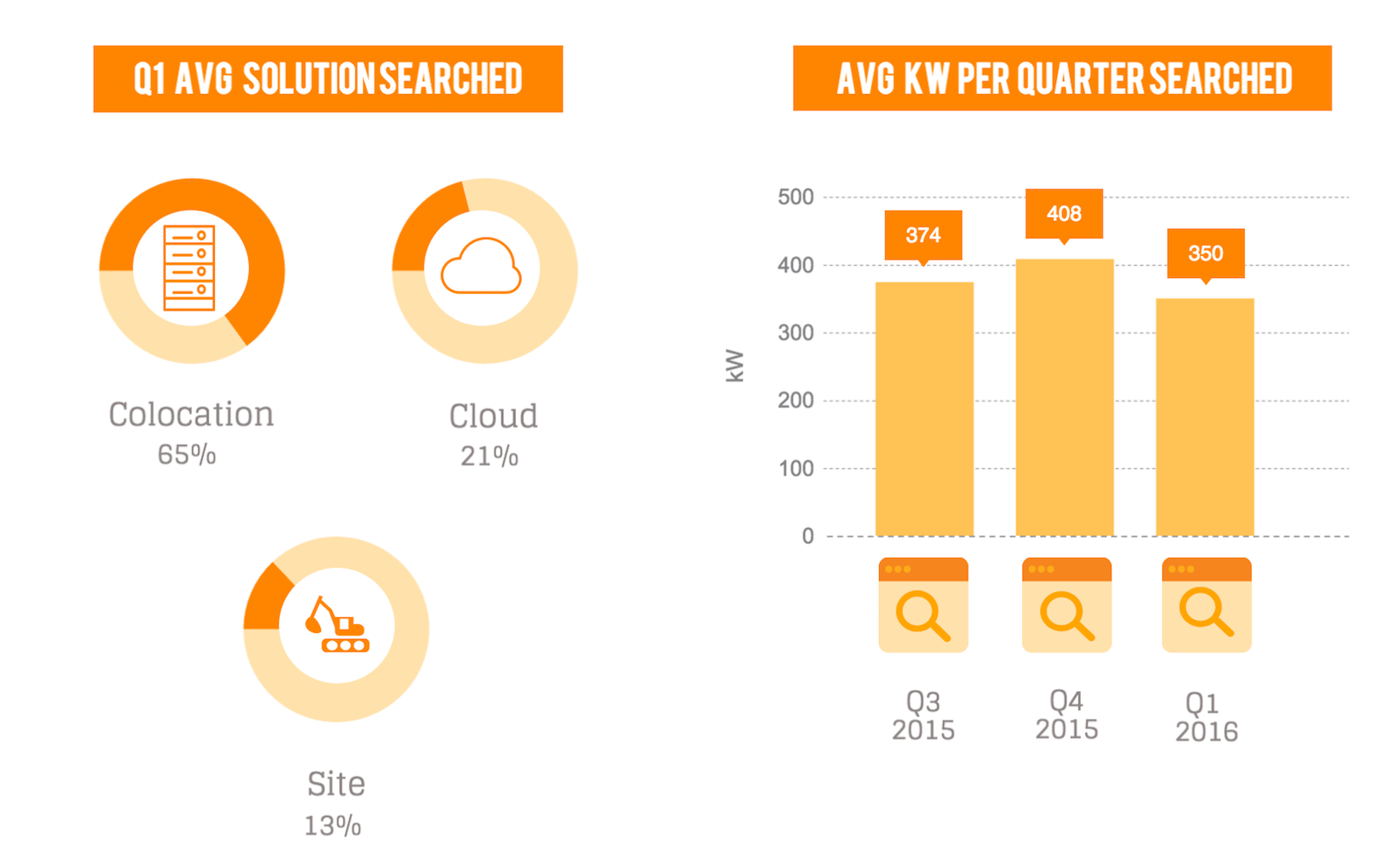

Despite cloud and colocation taking the majority of searches, some companies still are interested in owning their data centers and will search sites to solve for this. There was a slight dip in site search average. We anticipate it will get smaller over time.