By Luke Smith · 1/24/2024

In the ever-evolving terrain of global data center development, 4Q 2023 witnessed significant milestones across North America, Latin America, Europe, and Asia-Pacific, as hyperscale users navigated challenges, secondary markets gained prominence, and strategic trends shaped the future of data infrastructure.

North American Data Center Markets

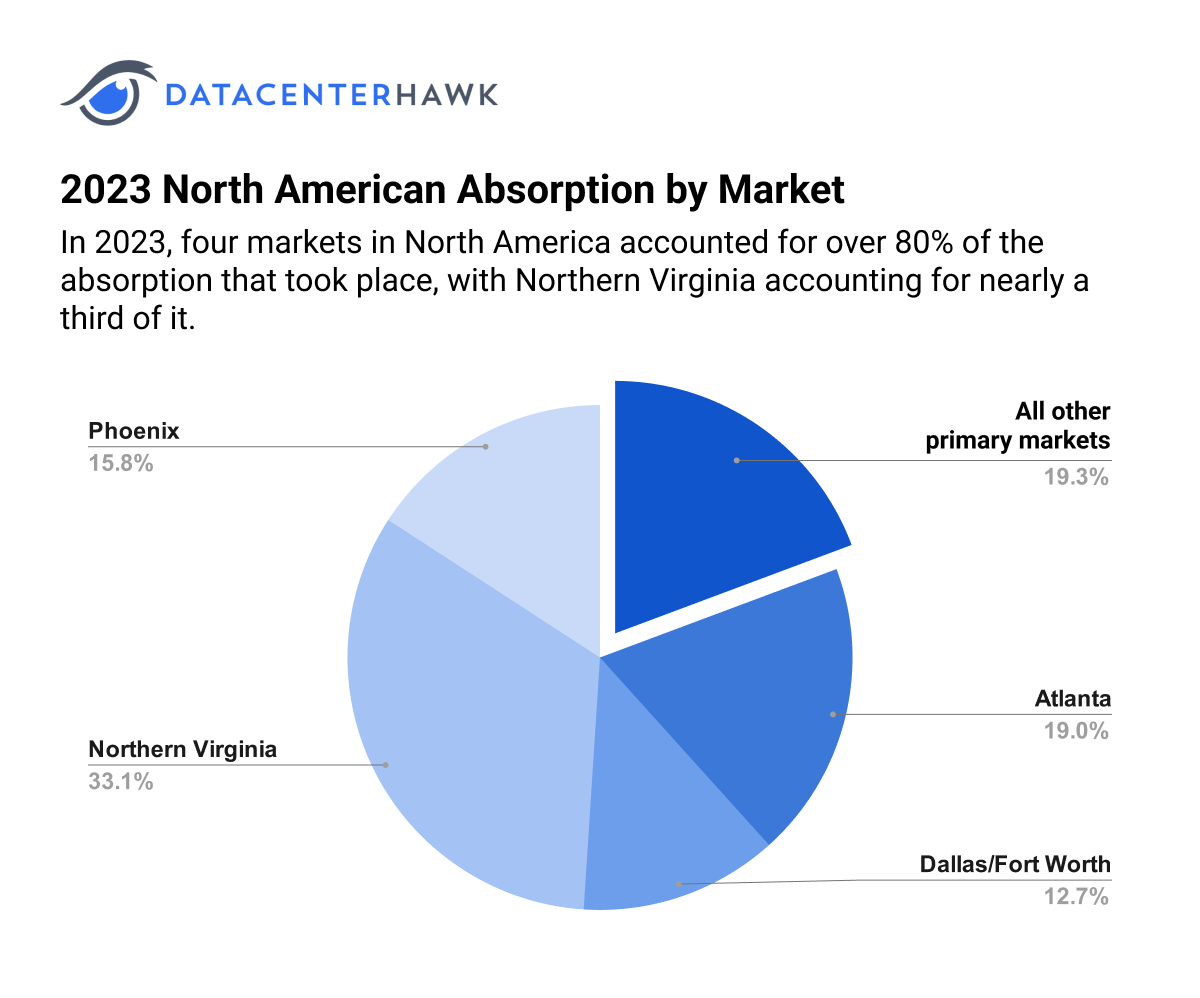

2023 North American Absorption by Market

North American data center development continues to charge forward, with over 1.4 GW of absorption in major markets in 4Q 2023, and nearly 4 GW for the year. Despite industry headwinds like the ability to secure utility power in popular markets, supply issues, and concerns surrounding the privacy behind biometric tech practices (BIPA), hyperscale users continued to sign lease agreements with providers across the board. Northern Virginia saw significant activity in 4Q 2023, with 601.3 MW of absorption – the region’s largest leasing quarter in history.

Notable Trends & Markets

Land Banking and continued migration to sub-markets:

Land-banking continued across North America, with the lion’s share of the activity being hyperscale users securing 6,400+ acres of land in 4Q 2023. Colocation providers also continued to secure land, often migrating out of power-constrained core-markets like Loudoun and Prince William counties, and moving to satellite sub-markets, like south Virginia’s I-95 corridor towards Richmond.

In order to keep up with ever-growing demand, providers have to go to the power, as opposed to bringing the power to the data center. In Chicago, we saw more activity move west from the main metro toward Hoffman Estates. In Phoenix, some of the land activity moved out towards Avondale. Real estate brokers in the industry have been bullish on Buckeye, AZ as a future sub-market that will likely draw the attention of developers. In Dallas, activity has moved south to markets like Lancaster. Atlanta saw over 1,000 acres purchased between hyperscale and colocation providers. Atlanta historically had most of their activity happen in the metro area, but we now see deployments moving out to markets like Lithia Springs, Fayetteville, and Covington.

Secondary Market activity:

Smaller, secondary and tertiary markets continue to garner attention from data center providers. Secondary markets with the most absorption in 4Q 2023 included Salt Lake City (121.0 MW), San Antonio (90.0 MW), Columbus (24.0 MW), and Northern New Jersey (20.3 MW). These markets benefit from smaller hyperscale deployments, requirements from AI companies, and often from their geography. They’ve also grown as a result of low-vacancy rates in markets like Northern Virginia and Northern California - regions where securing power from utilities continues to prove challenging.

Looking Forward

Markets like Denver are starting to receive more attention, as one provider just announced a 70 MW four-building campus. With limited state-level incentives, and smaller utility-side incentives, however, providers may continue to look more heavily in regions with more promise of cost-savings.

Other markets slated to gain momentum in 2024 include Reno, Charlotte, Miami, Austin, and some smaller mid-west markets in Ohio, Indiana, and Iowa. Triple-digit requirements are already evaluating these markets and will likely land in the near future. With affordable land, a path to power, and a growing presence by cloud providers, these markets will allow colocation providers to grow their footprints in underserved data center regions, while utilities in more established primary markets continue to work towards sustainable power planning to meet increased energy demands.

Latin American Data Center Markets

In 4Q 2023, the Latin American data center market saw an uptick in construction and a big jump in new projects being announced. Unfortunately, continued delays in electrical transmission projects in Queretaro continue to hold back several large builds. Due to this slowdown Santiago was able to retake 2nd place with regards to the commission power in the LATAM region after Sao Paulo. The region continues to mature, as well, with subsea cables, renewable energy projects, and new cloud regions in development.

Notable Trends & Markets

Secondary markets are now a reality in Latin America

Secondary markets have been around for several years in the largest markets but played a very limited role. These markets had one or two providers in telco grade sites with very limited power, and only offering retail colocation. Hyperscale users tended to concentrate the majority of their capacity in or close to the largest metropolitan cities but recently have begun to decentralize some of their deployments. Recent announcements from several providers advised that they have begun construction or are in the planning stages for new facilities in Rio de Janeiro, which currently has 47 MW of commissioned power. The Sao Joao de Miriti district in Rio will be adding 262 MW to support these deployments. Other secondary markets that are seeing new activity include Porto Alegre, Medellin, and Monterey.

Buenos Aires, the next regional opportunity?

The new administration in Argentina wants to implement a new system that will radically change the country’s strategy toward international investment and cooperation. Previous administrations are considered to have impeded the economy by borrowing too much, not repaying loans on time, overspending on government services, and implementing strict restrictions on capital outflows. The latest Foreign Direct Investment (FDI) figures show Argentina only receiving US$12B in 2023 vs. US$91B and US$50B for Brazil and Mexico respectively. Attracting new financial capital could make Buenos Aires an interesting opportunity for hyperscale companies and providers to greatly expand the current 45 MW in place today. Argentina currently has some of the lowest real estate and electricity rates in all of Latin America- between $0.025-$0.04 kWh. On top of that, new submarine cable capacity has been recently added to Buenos Aires offering more than 6X in incremental connectivity.

Brazil back in the Top 10

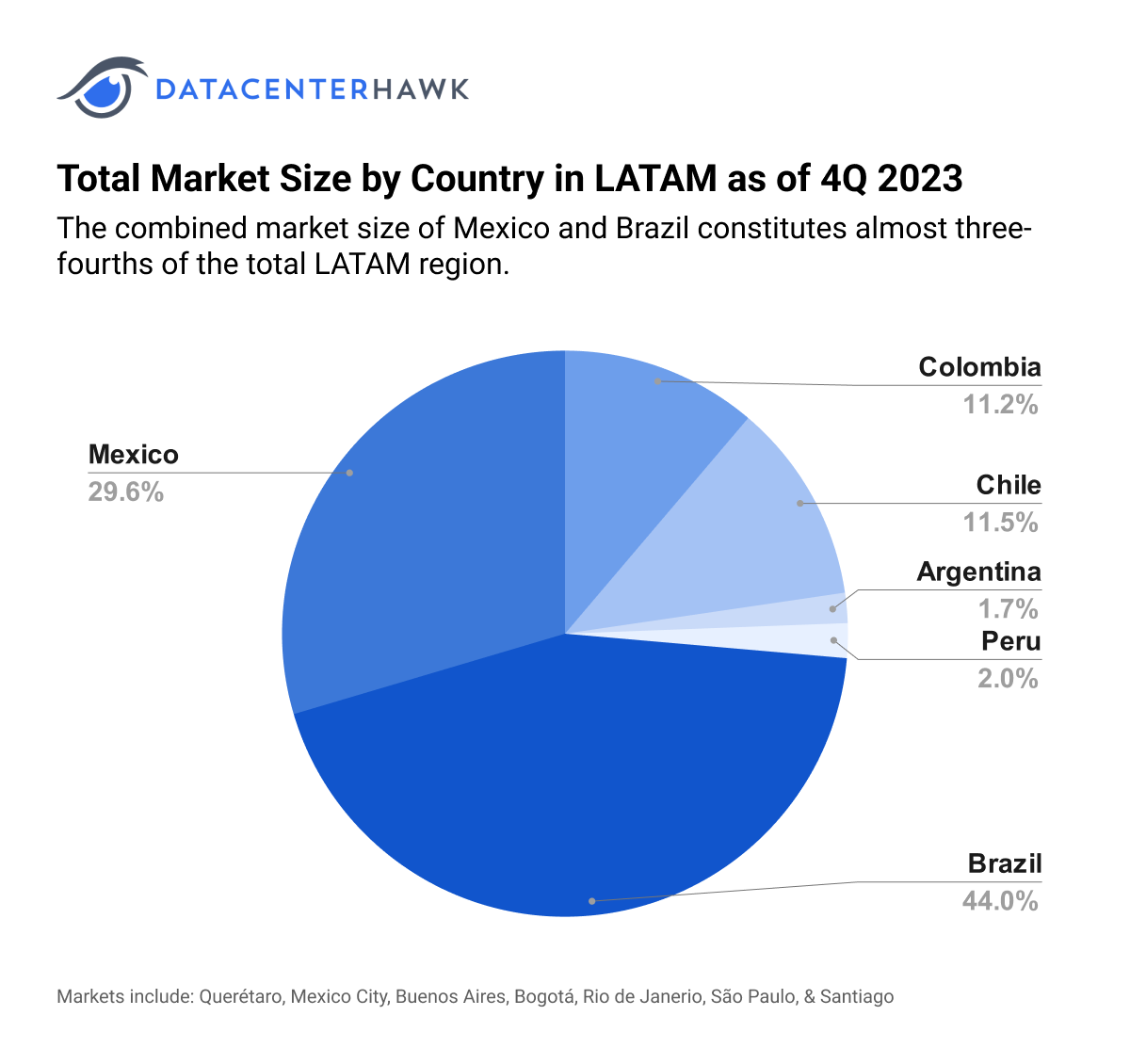

Total Market Size by Country in LATAM as of 4Q 2023

Brazil surprised many with a 3.2% gross domestic product (GDP) in 2023 which should make them jump two places and become the world’s ninth largest economy. Unofficially they ended 2023 with a GDP of US$2.23 trillion, overtaking Canada’s US$2.12 trillion. By 2026 Brazil should be in the position to become the 8th largest economy, which today is held by Italy, with an estimated GDP of US$2.476 trillion.

Looking Forward

Improving economies, state-of-the-art submarine cable systems that lower latency, and political shifts towards more open markets are changes that the region will need to support growth and begin developing a percentage of its 2 GW of planned data center capacity. Countries like Brazil, Uruguay, and Chile where renewal energy efforts continue to expand while they accurately forecast and invest in the electrical delivery infrastructure will drive more investment in their direction as they close the digital infrastructure divide with the rest of the developed world.

European Data Center Markets

Demand for data center infrastructure in Europe remains high despite regulatory obstacles and power supply issues. While absorption was down in some markets, other markets had record years. Development is occurring where it can and primarily where there is power. While a good portion of this is in major markets, it’s also creating opportunities for new regions and enables a compelling argument for some scale of development in nearly every European country.

Notable Trends & Markets

Significant development in Germany

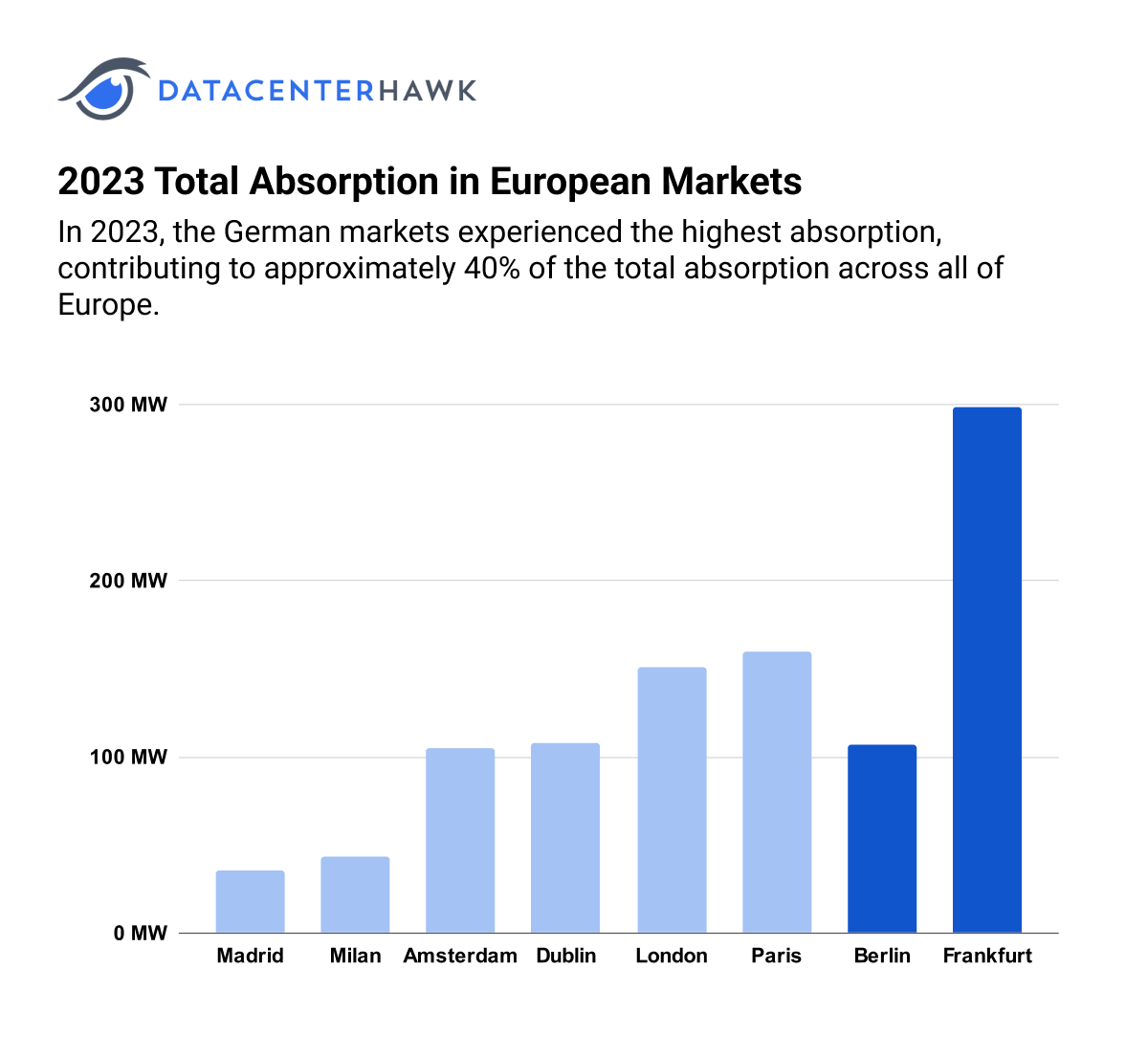

2023 Total Absorption in European Markets

Frankfurt and Berlin are some of the fastest growing European markets, both experiencing outstanding absorption in 2023 and offering ample planned development for future growth. Frankfurt currently has the largest amount of planned colocation power in Europe, at over 1.5 GW, while Berlin's 650 MW is the third most in Europe, directly behind London. The two markets also combined for over 400 MW of absorption in 2023, the most of any European country.

Lack of power contributing to new emerging markets

Issues of power supply and infrastructure in the FLAP-D markets led to substantial growth in markets like Madrid and Milan. The scale of demand seen, however, quickly resulted in limited power supplies in those markets as well. As a result, demand is spreading to multiple markets across Spain and Italy. Development in Barcelona and Zaragoza is high as cloud companies use those markets to establish their cloud region in Spain. While Italian demand comes from power issues in Milan, it’s also spurred on by strategic connectivity points along the entire peninsula.

Paris growing substantially due to hyperscale demand

Paris historically lagged behind other major European markets, averaging under 50 MW of annual absorption between 2020-2023. While 2023 was a standout year for Paris with nearly 80 MW of absorption, it was greatly eclipsed by the 160 MW absorbed in 2024. While development can be lengthy in Paris, it’s a market that is less constrained by power supply issues. New competition has also come to Paris in the form of new providers and new hyperscale campuses.

Looking Forward

Development in Europe is going to continue to migrate from the existing major markets and into new areas where power can be procured. Similar to Berlin’s growth as an alternative to Frankfurt, new cities adjacent to major markets will likely see elevated interest. Providers also continue to probe eastward and develop their presence in the Mediterranean.

Asia-Pacific Data Center Markets

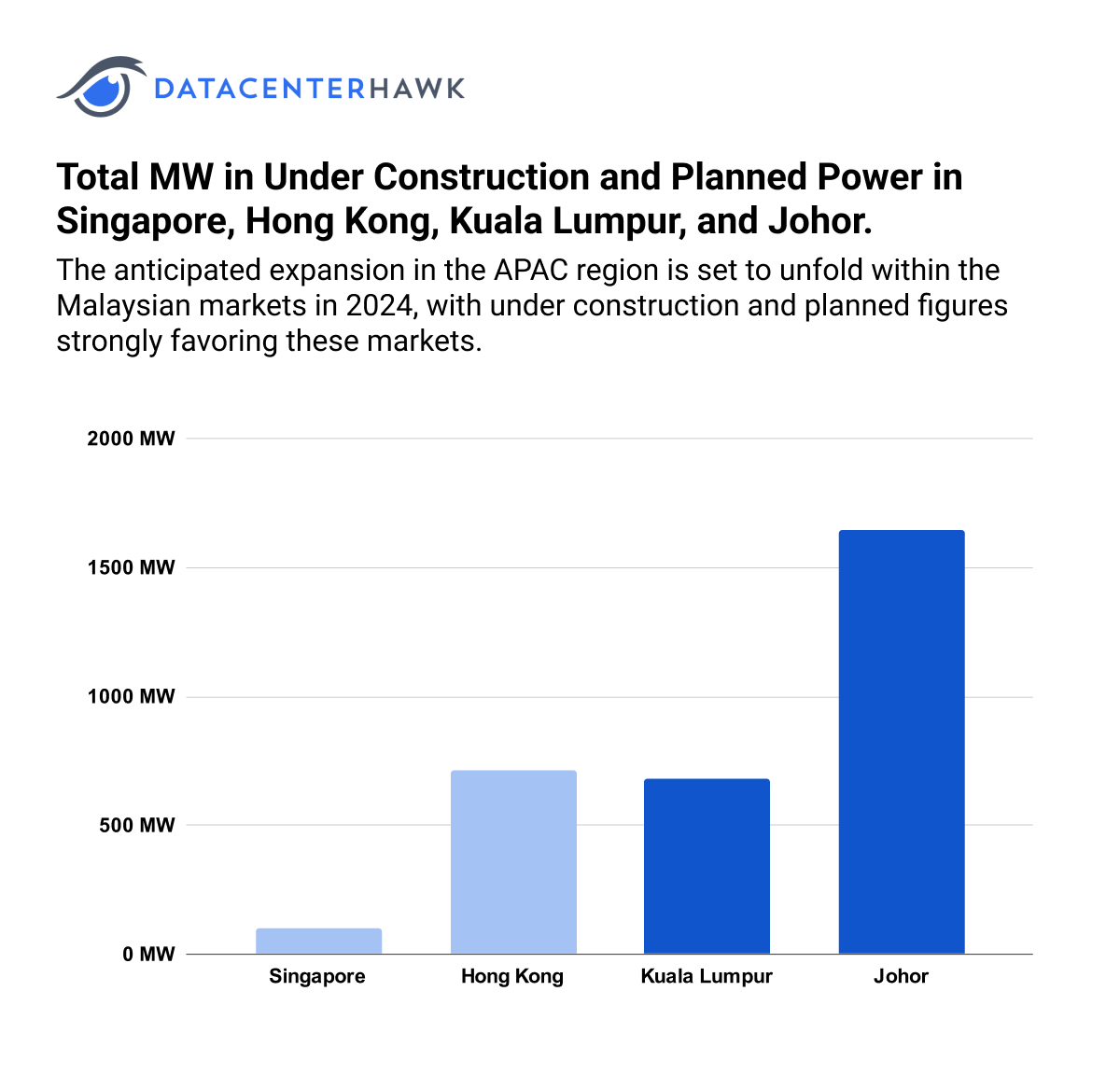

Johor currently spearheads absorption in APAC, driven by the increasing demand for regional services catering to AI and various workloads across the entire Asia Pacific. While Johor was once positioned as an alternative site for data center deployments to Singapore, it now takes the lead in absorption, capacity under construction, and planned power, attributed to government incentives like the Malaysia Digital Status from MDEC and Investment Tax Allowance from MIDA, alongside the availability of land and power resources.

Total MW in Under Construction and Planned Power in Singapore, Hong Kong, Kuala Lumpur, and Johor.

Notable Trends & Markets

Johor and Singapore partnering to continue to develop Pacific data hub

An MOU was signed between Johor and Singapore to establish a Johor-Singapore Special Economic Zone (SEZ). A joint committee that is co-led by Singapore’s Ministry of Trade and Industry(MTI) and Malaysia’s Ministry of Economy was formed to oversee its implementation. The meeting to discuss the scope of the collaboration occurred in Oct ‘23 and the MOU was concluded and signed in Jan ’24. This helps improve cross-border goods flow and more importantly the flow of people who work on both sides which helps SEZ investor companies secure the specialized manpower for their operations. Renewable energy availability is also being studied as part of the MOU. With the new surge in developments, grid and power operators and trying to catch up and also balance land-banking of power vs actual utilization when making their investments.

Providers rearranging space to add capacity

In markets like Singapore and Hong Kong where supply is low, demand is high, and land for expansion is scarce, some providers are finding ways to add capacity by modifying their existing data center assets. While some opt to improve systems to increase the efficiency of their data center, others are also carefully shifting tenants and other building infrastructure to free up stranded capacity or create new pockets for more raised floor.

Looking Forward

Designs for higher density deployments will be required. Look forward to more direct-to-chip or liquid cooling for both training and inference deployments. Less real estate space will be required but higher floor loadings at the white space level. We will start to see development of larger capacity equipment like generators and transformers with higher voltage substations to support campus deployments. As a result, speculative capital will be spent more aggressively in markets that can accommodate campus development, with a runway to large amounts of power.

Stick with datacenterHawk to track data center trends in 2024.