By Luke Smith · 1/29/2025

North American Data Center Markets

Notable Trends & Markets

Northern Virginia, Atlanta, and Phoenix still lead, while absorption broadens

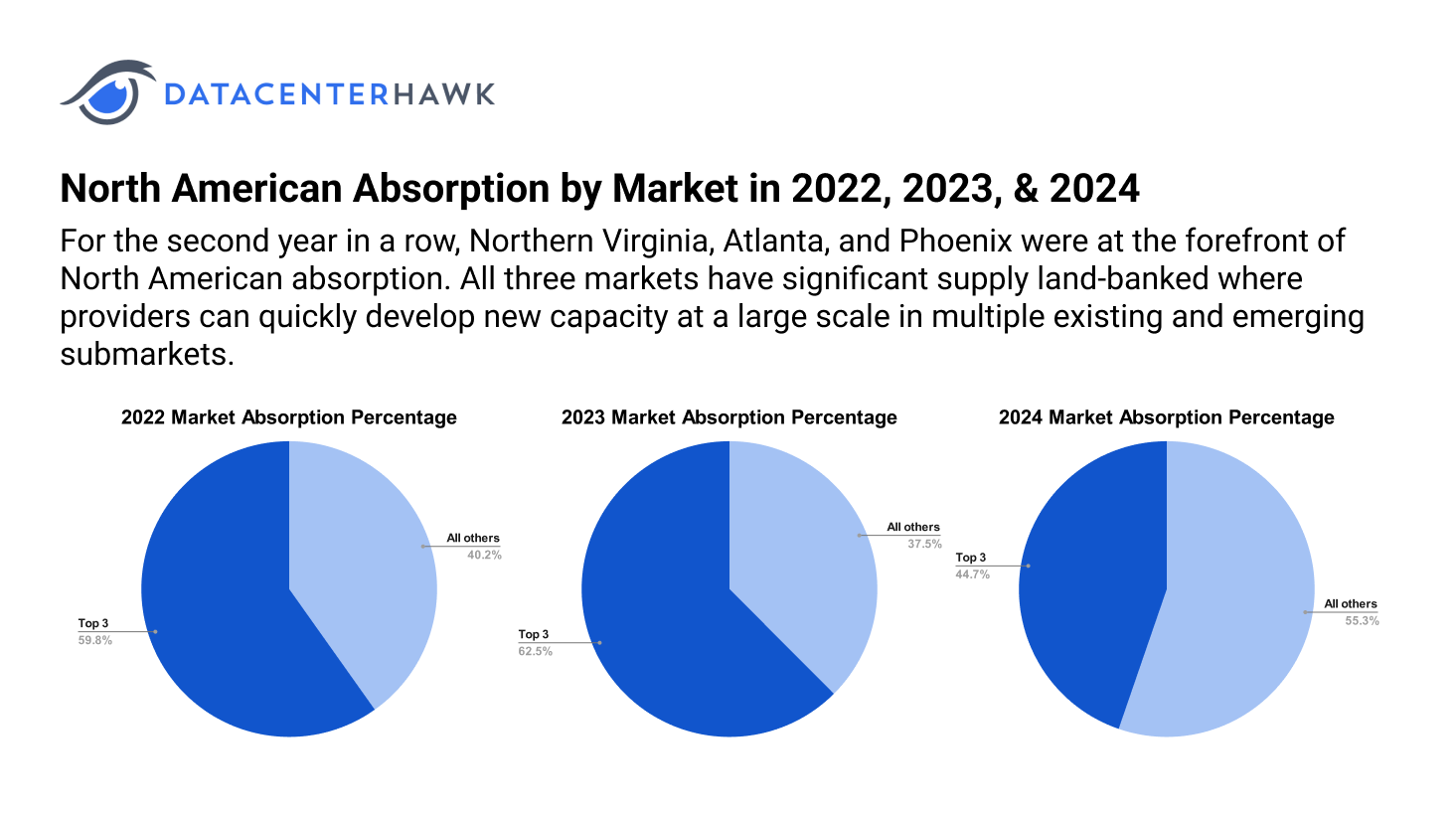

For the second year in a row, Northern Virginia, Atlanta, and Phoenix were at the forefront of North American absorption. All three markets have significant supply land-banked where providers can quickly develop new capacity at a large scale in multiple existing and emerging submarkets. Like many North American markets, Northern Virginia, Atlanta, and Phoenix experienced record-setting absorption in 2024, despite also doing the same in 2023. However, 2024 was the first year that the top three markets represented less than 50% of the region’s total absorption, further indicating the broadening of demand into more markets.

North American Absorption by Market in 2022, 2023, & 2024

Lack of high-voltage transmission lines hindering growth in emerging markets

High demand and long timelines for power procurement in major markets resulted in the emergence of many alternate markets throughout North America, as requirements focused less on geographic location and more on the availability of power. While this strategy is alleviated some demand pressure, developers are finding it is incomplete. The scale of many of these developments, often in the multi-hundred-megawatt range, makes the vast majority of transmission lines unsuitable. In some situations, even robust 345 kV lines are inadequate, resulting in utility companies investing in larger 500 or 765 kV lines, a costly and time-consuming process.

Land-owners evaluating “per MW” sales in favor of “per acre”

Emerging cooling technology is enabling incredibly high densities, while data center requirements are also necessitating smaller data center footprints to maximize the amount of capacity that can be deployed on a limited amount of space. As a result, data center developments are focusing less on the acreage of a site and more on the utility power available. As power is the primary metric considered for a land sale, some landowners and prospective buyers are exploring options to structure land sales on a cost-per-megawatt basis instead of cost-per-acre. Currently, this shift remains primarily conceptual and has yet to materially impact the way the industry acquires land.

Looking Forward

The path to power is tightening in most major markets and obstacles are arising in many of the emerging markets. Despite this, it’s unlikely absorption will decrease in a material way. To mitigate some of these delays, developers are pursuing opportunities further away from the urban core, often in suburbs where no data center development had taken place. While demand and absorption are unlikely to change, it’s anticipated it will continue to spread to new submarkets.

Latin American Data Center Markets

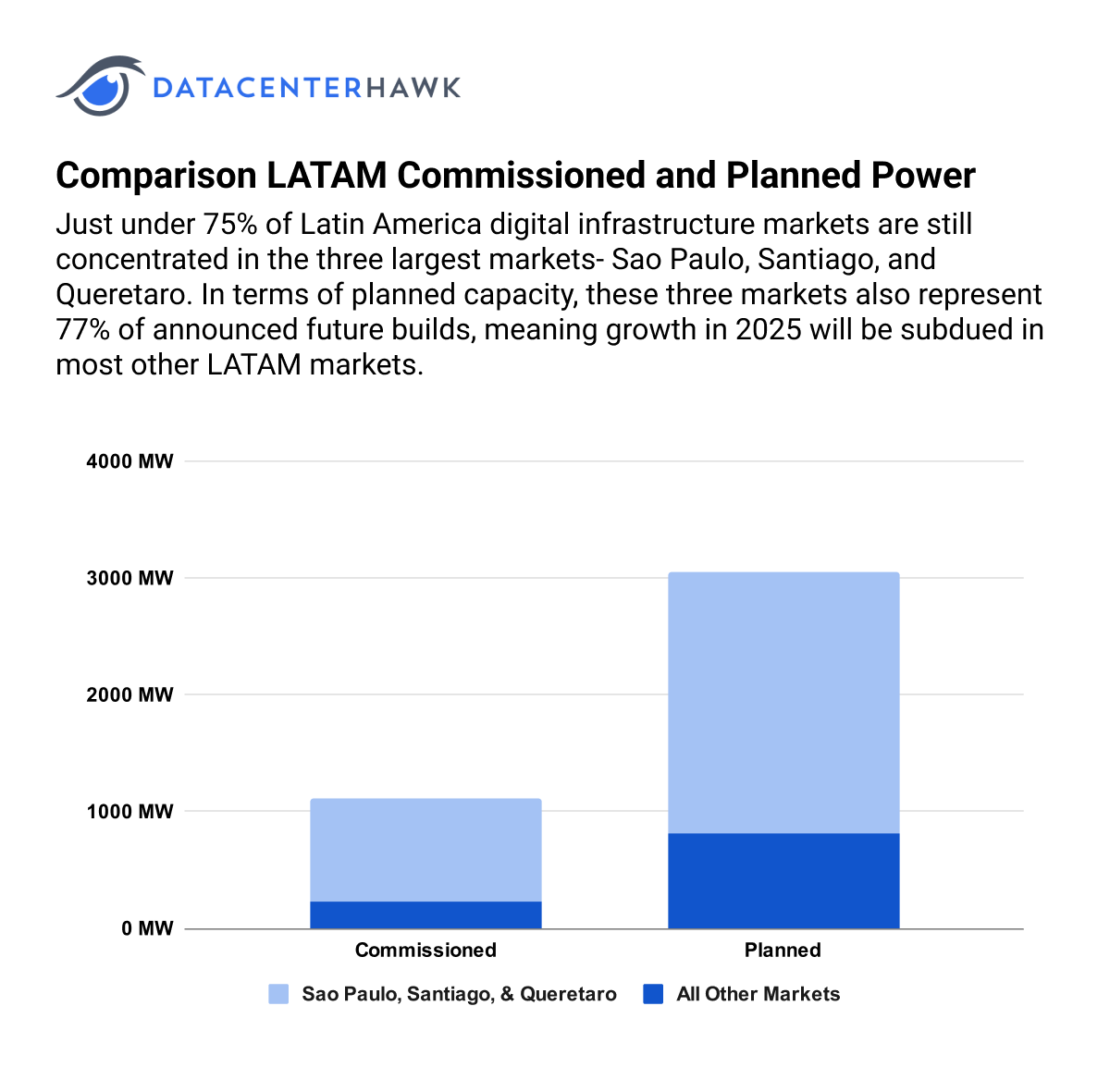

Just under 75% of Latin America digital infrastructure markets are still concentrated in the three largest markets- Sao Paulo, Santiago, and Queretaro. In terms of planned capacity, these three markets also represent 77% of announced future builds, meaning growth in 2025 will be subdued in most other LATAM markets. Rio has become an important secondary market while Bogota is experiencing some limited activity after a slow 2024. Sao Paulo is also seeing announcements larger than 100 MW, including Scala’s 456 MW, Ada’s 240 MW, Tecto’s 200 MW, Elea’s 100 MW, and an unnamed provider is planning 288 MW in Cabreuva, reflecting an increased demand for larger deployments.

Comparison LATAM Commissioned and Planned Power

In 2024 Latin American absorption doubled all of 2023 absorption. Sao Paulo remains the regional leader with just under 515 MW of commissioned capacity and 1.5 GW of planned capacity. Santiago continues to grow as the second largest market, while growth in Queretaro is sporadic due to the limited power availability in the market.

Notable Trends & Markets

Latin American emerging as an area of opportunity for AI deployments

Many aspects of Latin America are attractive for larger AI deployments. Most countries offer substantial renewable resources like hydroelectric, solar, and wind. Brazil anticipates it will be generating 96% of its electricity from renewables by 2028. Electricity and land costs are also favorable compared to other global regions. In Porto Alegre, Scala is developing its $50 billion AI City that could offer up to 4.75 GW of total power. One obstacle to AI development in Brazil, however, is large import tariffs that doubles the cost of chips. As a result, developers are evaluating areas outside of Brazil to serve Brazil’s AI needs. To further mitigate costs, Foxconn is building an NVIDIA manufacturing facility in Guadalajara to produce GB200 superchips that can support 60-120 kW per rack.

Desarrollo Pais Chile looking to significantly grow regional connectivity

Desarollo Pais, a Chilean state agency focused on growing infrastructure projects locally, has issued an RFP to find partners interested in building a significant fiber option network interconnecting major markets in Chile, Argentina, and Brazil. They are the same entity that partnered with Google to develop the submarine cable Humboldt that will be the first direct connection between Latin America and Asia.

Looking Forward

The region will likely continue its impressive growth in 2025 if we base the assumption on historical growth and what is being planned. What is still not very clear is what secondary and tertiary markets will develop in the quest for power. The development of Scala’s AI city south of Porto Alegre would be a great start to this expansion.

European Data Center Markets

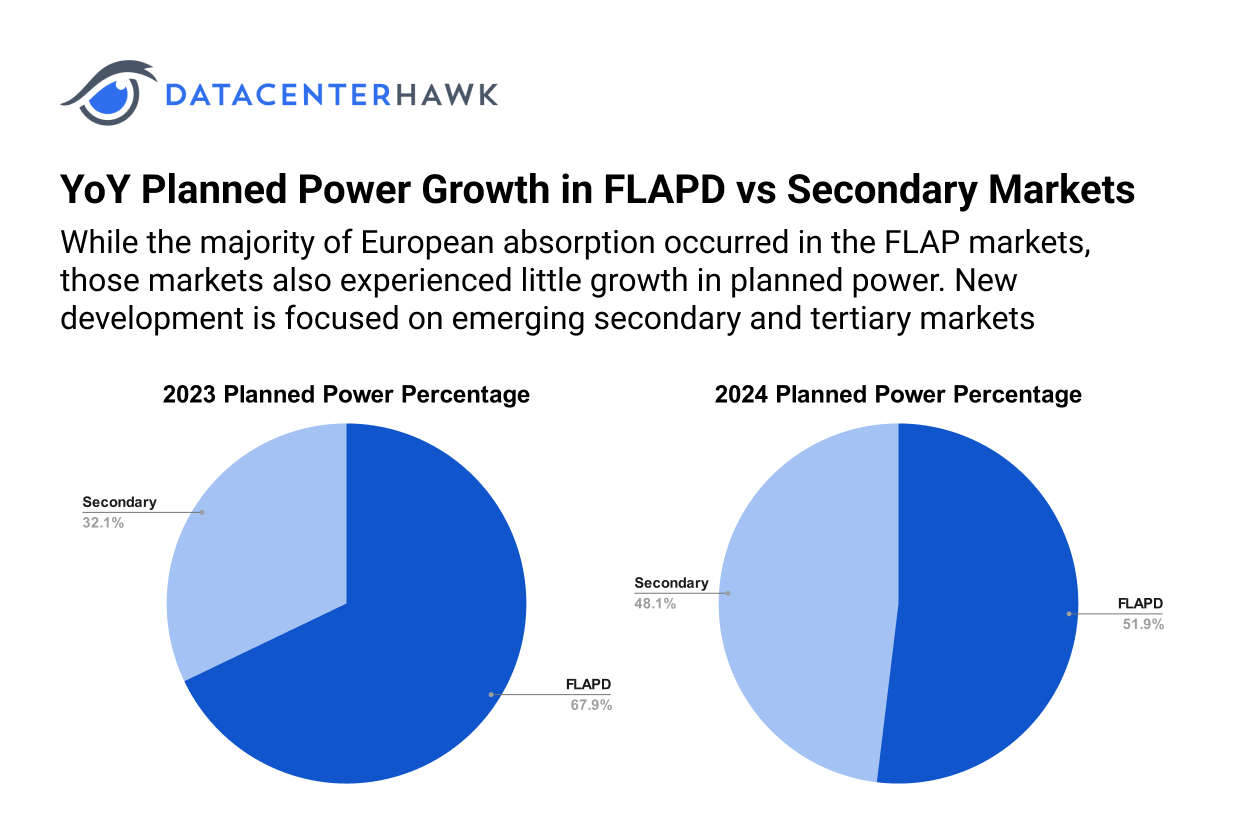

The European data center landscape is undergoing a significant transformation, driven by growing digital demands and strategic investments across the continent. While the majority of European absorption occurred in the FLAP markets, those markets also experienced little growth in planned power. New development is focused on emerging secondary and tertiary markets, primarily in Southern Europe. These regions are not only attracting investments from global tech giants but are also reshaping connectivity patterns, infrastructure capabilities, and economic landscapes. However, navigating this expansion comes with unique regional challenges, such as securing power in competitive markets like the UK, where land and an approved data center project are prerequisites for power allocation. Against this backdrop, the rise of these regions offers a compelling narrative of Europe's digital evolution.

YoY Planned Power Growth in FLAPD vs Secondary Markets

Notable Trends & Markets

Iberian Peninsula emerging as a major hub for hyperscale development

The Iberian Peninsula is rapidly becoming Europe's next hub for data center development. Major players are stepping in, with DAMAC’s EDGNEX investing €400 million in a 40 MW data center in Madrid, set to be operational by 2026. Meanwhile, CVC Capital Partners has acquired Adam Ecotech, which operates facilities across Madrid and Barcelona. In Galicia, Galicia Green Data Center is breaking ground on a 40 MW facility in Curtis, with plans to launch by 2026. Not far from Madrid, Meta's €750 million investment in a data center in Talavera de la Reina signals the region’s growing appeal to global tech giants. These initiatives, alongside Iberdrola’s potential €2 billion investment in Bilbao, highlight the Iberian Peninsula's emergence as a focal point for the data center industry.

In Zaragoza, the demand for data centers continues to rise with QTS, a Blackstone company, announcing a €7.5 billion investment in a 500 MW facility. Box2Bit is also preparing to invest €3.4 billion in a project set to be completed in 2029. Microsoft and AWS have committed €22.3 billion to the Aragon region, with Microsoft investing €6.6 billion near Zaragoza and AWS dedicating €15.7 billion to expand its cloud region. Meanwhile, in Lisbon, Edged Energy is developing a 180 MW project, and AtlasEdge is enhancing its presence across Portugal, securing over 20 MW in Lisbon alone. With these expansive projects, the Iberian Peninsula is quickly becoming the European equivalent of Virginia, attracting global investments and positioning itself as the key to the future of digital connectivity.

Greece’s connectivity and central location contributing to real estate boom

Greece is rapidly becoming a key player in the global data center landscape, attracting major investments that position it as a strategic hub for connectivity between Europe, Asia, and the Middle East. With an increasing number of large-scale projects in development, the country is set to become a central point in the digital infrastructure boom.

Apto has partnered with Dromeus Capital Group to develop a €300 million hyperscale data center in Athens. The project has secured pre-approval and high-voltage power, setting the stage for significant growth in the region. EDGNEX, a subsidiary of DAMAC, is also entering the Athens market with a €150 million investment in a new data center, initially offering 12.5 MW capacity, with plans for expansion to 25 MW. Construction is set to begin in the first quarter of 2025, with the first phase scheduled for completion in two years. Data4 is also making a major move in Athens, investing €300 million to develop a 90 MW data center, further adding to the country's growing digital infrastructure.

Digital Realty is expanding its Mediterranean presence by focusing on Crete as a key hub for global data connectivity. This expansion will enhance low-latency routes connecting Asia, the Middle East, and Europe, ensuring reliable and efficient data exchange. Meanwhile, Grid Telecom is planning to build a cable landing station in Crete, part of Quadrivium Digital’s 20 MW data center campus, which will serve as a critical node for international subsea cables. Additionally, IPTO Greece and Serverfarm have partnered to create Gemini, a joint venture to build a 130 MW hyperscale data center in Athens, further strengthening Greece's emerging role in global digital infrastructure.

Data center development spreading throughout the Italian Peninsula

Italy is becoming a key player in Europe’s digital transformation, with major investments flooding the country’s data center sector. Microsoft is making a significant push, investing €4.2 billion in Northern Italy to expand its hyperscale cloud and AI infrastructure, while launching a digital skills training program aimed at reaching over 1 million Italians by 2025. Aruba S.p.A. plans to invest €300 million to build five data centers in Rome, offering a combined 30MW of IT capacity. Additionally, Google’s parent company is in talks with the Italian government to establish a base station in Sicily as part of a Mediterranean fiber optic cable network.

AWS is committing €1.2 billion over the next five years to expand its data center footprint in Italy, further boosting the region’s digital capabilities. Telecom Italia (TIM) is developing a 25MW facility set to be operational by 2026, with a €130 million investment, while CyrusOne plans a 25MW data center in Milan, with the first 9MW scheduled for completion by 2027. With these strategic investments, Italy is positioning itself as a cornerstone in Europe’s growing digital infrastructure network.

Looking Forward

As Europe solidifies its position as a global leader in digital infrastructure, the continued development of key regions like the Iberian Peninsula, Greece, and Italy will redefine connectivity and cloud accessibility across continents. However, challenges such as power procurement, regulatory hurdles, and sustainability demands will require innovative solutions and strategic collaboration. By addressing these complexities, Europe’s emerging hubs are poised to rival the established leaders in the data center world.

Asia-Pacific Data Center Markets

APAC experienced strong demand for hyperscale data center space in 2024, primarily in emerging markets throughout the Pacific. Although substantial growth occurred in markets like Jakarta, Bangkok, or Kuala Lumpur, the most impressive growth came from Johor. The market emerged as a prime candidate for large-scale development due to its large quantity of land and inexpensive power costs. While development remains subdued in many major APAC markets, outside of Australia, these new markets are supporting the region’s growth.

Notable Trends & Markets

Demand spreading throughout Australia

Although many markets are emerging throughout Southeast Asia, Australia remains the primary source of absorption in APAC. Between NextDC and CDC new and planned developments in Sydney, the market can grow by an additional 1 GW. Melbourne is also emerging as an attractive hyperscale alternative as power grows scarce in Sydney. Perth, on Australia’s western coast, is also a strategic option as the markets in Southeast Asia and India grow. Perth’s proximity to these areas carries a strong strategic benefit for connectivity throughout APAC.

Substantial capital flooding into APAC from third-party investors

While new developments are occurring throughout APAC, the primary story of the fourth quarter was investment and acquisition. For example, DAMAC-owned Edgnex invested over $1 billion USD as part of a joint venture with Proen to develop hyperscale data centers throughout Southeast Asia. HMC Capital is also set to acquire iseek’s assets for AU$400 million as well as Global Switch’s Australia-based business for AU$2.12 billion.

Looking Forward

It is likely growth in APAC will remain somewhat subdued during the first half of 2025. Large-scale pre-leasing is contributing to a “digestion period” where developers are focused on delivering pre-leased assets before committing to knew endeavors. A lack of power and space in emerging markets will also contribute to slower growth. Demand remains high, however, and periods of substantial absorption will return.