By Luke Smith · 8/7/2024

North American Data Center Markets

Total absorption in North America was at its lowest point since 2Q 2023, though still above 1 GW. Demand, however, remains high and is primarily bottlenecked by a lack of data center supply and power transmission obstacles in most markets. Many markets have substantial amounts of planned capacity, but very little could be delivered within the next two years, resulting in slightly subdued leasing. Despite this, North America is on track to surpass the previous year’s absorption yet again.

Notable Trends & Markets

AI representing a material source of absorption

AI is not a new subject, though it is now seriously leaving its nascent stage. Over the last 18 months, industry professionals could only speculate on AI’s impact on the data center industry and absorption; however, we now have a somewhat clearer picture. Although not the dominant source of absorption, AI demand represented a substantial portion of overall absorption in the US through the first half of 2024. While AI requirements are known for relying less on physical locations and latency, most absorption from AI occurred in major colocation markets.

Atlanta growth boom continues

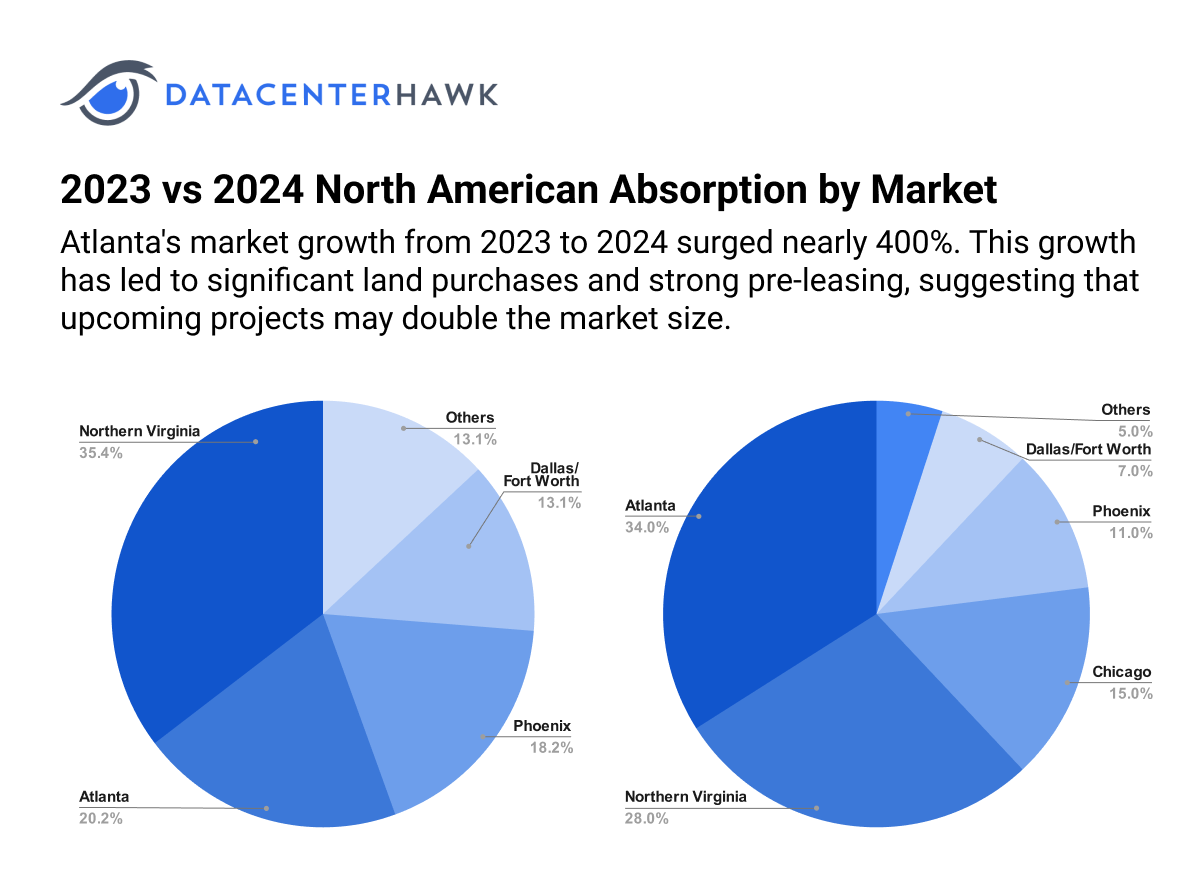

Atlanta’s growth through 2023-2024 is unmatched. In the last 12 months, the market grew nearly 400%, amounting to approximately 1.5 GW. This triggered substantial purchases of land for future development. Despite significant pre-leasing, planned projects in the future could double the market’s total size. Atlanta can meet the needs of multiple groups, offering ample space for enterprise users, as well as the low costs and availability of land required by hyperscale and AI users.

2023 vs 2024 North American Absorption by Market

Looking Forward

While the availability of power is the primary force behind market selection, the availability of land is gaining priority. This is one factor behind the continued growth in major markets such as Dallas, Atlanta, and Phoenix, while markets like Chicago and Northern California are more subdued. Brownfield development is an option for many groups, but many users and providers are currently favoring greenfield development.

European Data Center Markets

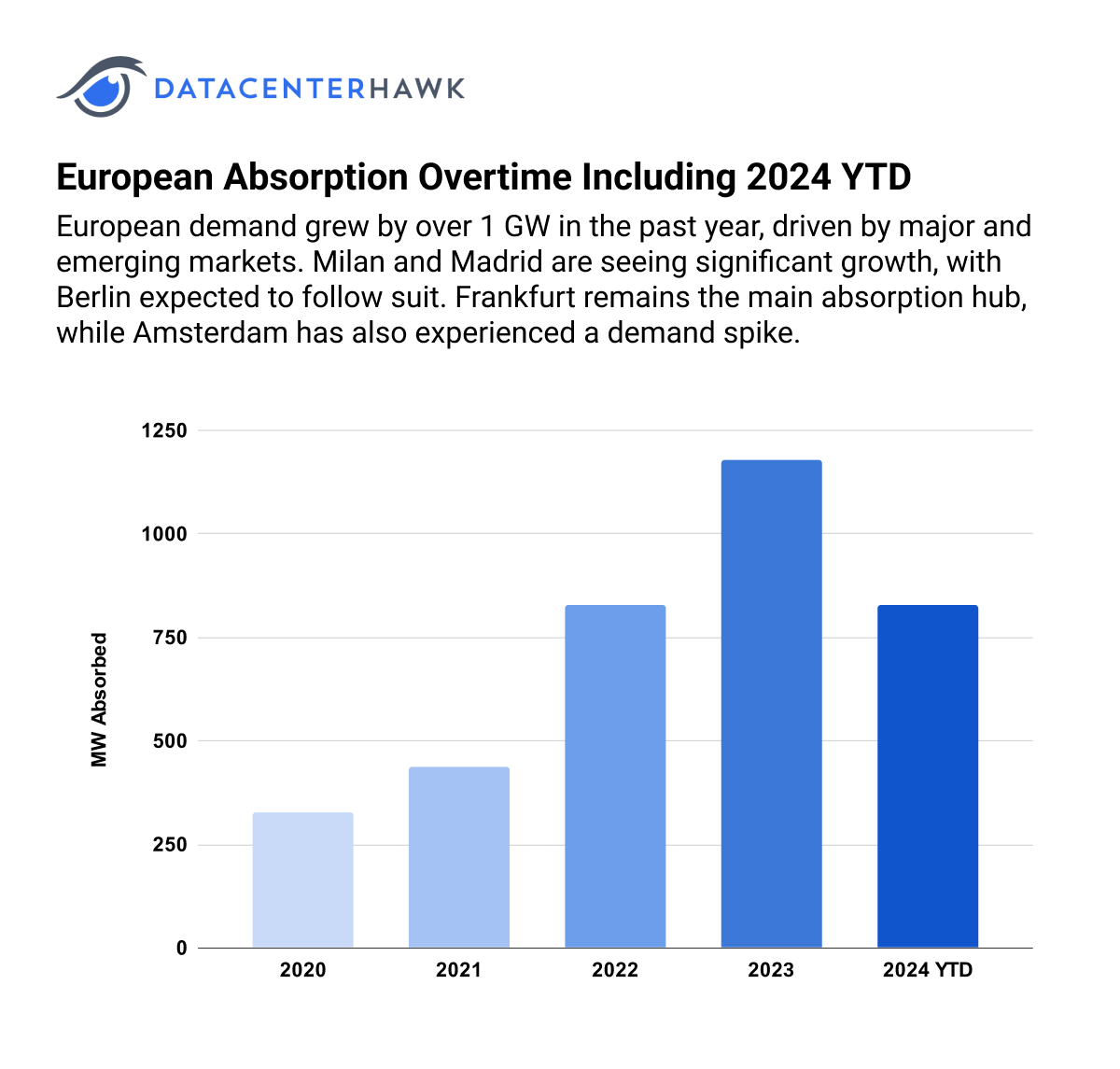

European demand is at an all-time high. The region grew by more than 1 GW over the trailing four quarters, with demand in major existing markets and emerging markets as well. Milan and Madrid are experiencing substantial growth, while Berlin is positioned to see similar results. Frankfurt continues to be the primary source of absorption, while Amsterdam also saw a spike in demand.

European Absorption Overtime Including 2024 YTD

Notable Trends & Markets

Pan-Spanish demand generating new development in Barcelona

Data center demand in Spain is very high. The region is attractive for large-scale operators due to its relatively low construction and operating costs, resulting in substantial plans for hyperscale development in Madrid. Spain is also highly strategic from a connectivity perspective, acting as an entry point from the Americas and Africa into Europe, as well as throughout the Mediterranean. As demand quickly outpaced transmission infrastructure in Madrid, opportunity arose for development in Barcelona. Hyperscale development is also occurring in Zaragoza.

Nordics pushing for AI and hyperscale development

The first half of 2024 saw renewed interest in large-scale development in the Nordics. Strategy and regulatory hurdles in the region have tempered some potential development recently, but many groups are now evaluating deployments in many major Nordic markets. Local governments are eager to attract responsible development. Furthermore, many requirements currently put less emphasis on latency and more on the availability of land and power, which the Nordics can easily provide.

Looking Forward

Cloud demand will continue to drive absorption, along with AI in a few key markets. While AI demand isn’t particularly strong in most European markets, which accounts for slower European growth compared to other regions, AI companies are interested in Nordic markets. Overall absorption will likely remain strong, while market-level absorption will be lumpy with periods of new supply and digestion. Whether it occurs in major or emerging markets, however, Europe is on track to surpass the previous year’s absorption.

Latin American Data Center Markets

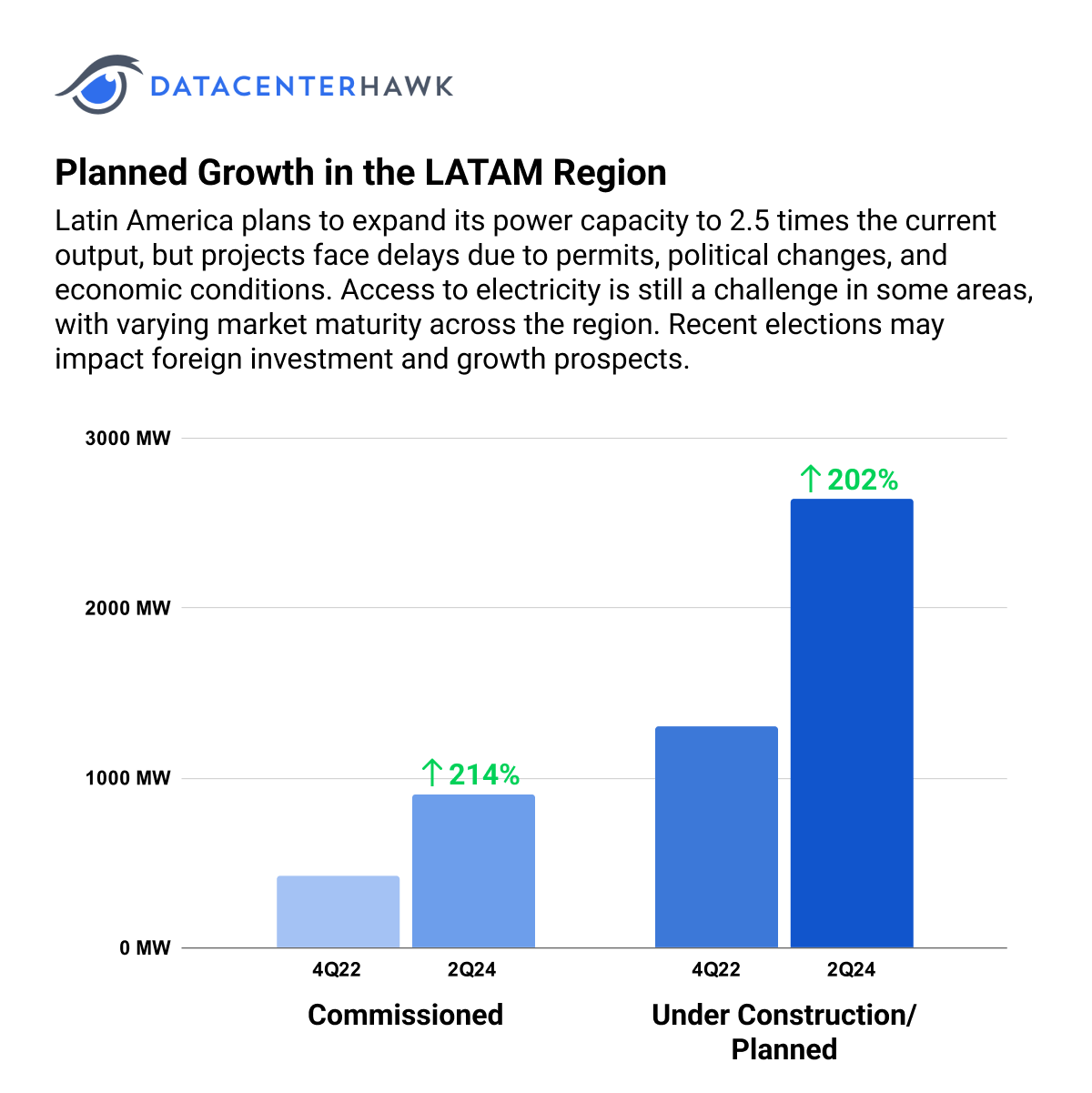

Latin America continues its impressive growth in digital infrastructure as the region adapts to political shifts, macroeconomic stabilization, ever-improving connectivity, renewable energy efforts, and addressing power constraints. As a region, Latin America has approximately doubled its commissioned power capacity in just 18 months- 650 MW in 4Q 2022 to 1,195 MW at Q2 2024. Sao Paulo continues to outpace all other Latin American markets with half of the overall capacity.

Notable Trends & Markets

Cloud demand will drive Mexican expansion as transmission solutions emerge

Cloud zones are expanding into Mexico. Microsoft announced that their Azure Availability Zone called Mexico Central Region is in operation as of May. Earlier this year, AWS announced that they will have their Mexico Central Region in operation in early 2025. This is the second region in Latin American for both providers after Sao Paulo. Oracle and Huawei also have cloud regions in operation today and Alibaba has announced that they will be launching a Mexican region soon. In Queretaro, some industrial parks are investing hundreds of millions of U.S. dollars to subcontract out transmission line expansions to assure electrical capacity in the near term rather than wait for CFE/CENACE to deliver in 2026 and beyond. Two parks in particular have roughly 400 MW of capacity coming online in the first half of 2025 and this is attracting data center providers and hyperscaler users that are willing to pay a premium to reserve this power.

Brazil experiencing self-built boom and pioneering renewable energy strategies

After almost ten years of leasing space in the Sao Paulo region, two hyperscale companies have built or are in the process of building their own facilities. AWS has two sites in Paulinia & Jundai that are operational while Microsoft has three under construction one in Sumare and two in Hortolandia. While the U.S. is more balanced with regards to the self-built vs. leased sites Latin America is much more heavily weighted towards leased sites. With self-built sites now in Mexico, Chile, and Brazil it looks like hyperscalers are starting to shift this balance. Part of this is due to the region’s substantial renewable resources. Thanks to its vast hydro infrastructure and ongoing boom in wind and solar installations, Brazil will get 96% of its electricity from a renewable source by 2028. Renewables met 90.2% of the country’s power requirements in 2023. Currently Brazil’s wind farms have a combined capacity of 30 GW and its solar farms have a total nominal capacity of 11.8 GW (Distributed solar capacity which includes roof panels-was 26 GW) By 2028, wind and solar will make up 38% of annual electrical output.

Looking Forward

Latin America’s planned capacity is almost 2.5X the current commissioned power and continues to grow every quarter. In some markets access to electricity has been the delay but other factors like permits, political shifts, economic conditions or market demand have delayed projects. Longer planning cycles and flexibility is the name of the game in several LATAM countries as some markets are in early stages of maturity others are just getting started. What remains to be seen is the impact of shifting political landscapes. As a result of recent elections, some countries are far more interested in attracting foreign investment while others could hinder growth.

Planned Growth in the LATAM Region

Asia-Pacific Data Center Markets

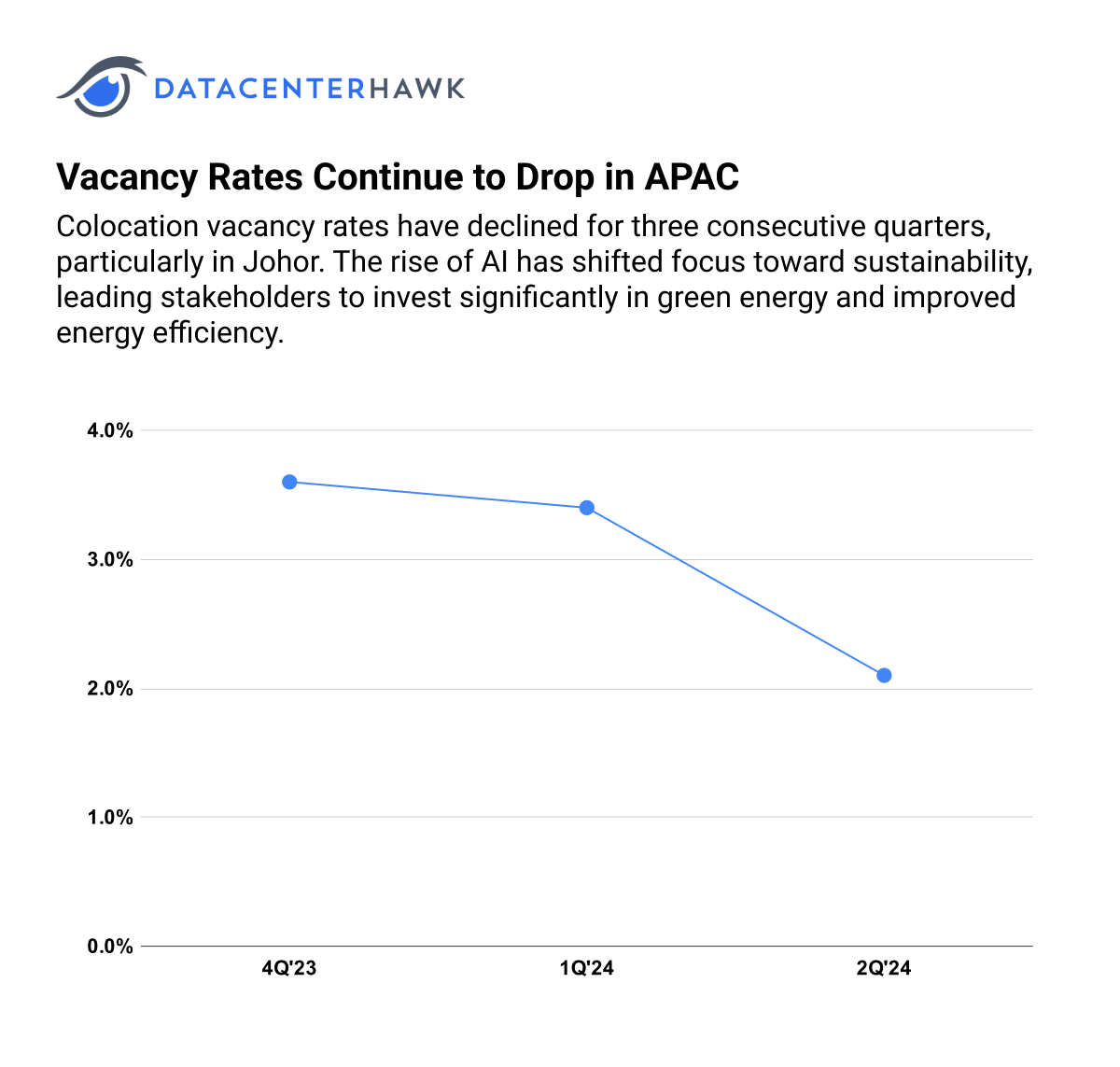

Colocation vacancy rates have been dropping for three quarters in a row, with the lowest in Johor. With the acceleration of AI, sustainability has become a major topic in the market, prompting various stakeholders to embrace the challenge of sustainability. This is evident in the large volumes of investments into green energy usage and achieving higher energy efficiency.

Vacancy Rates Continue to Drop in APAC

Notable Trends & Markets

Singapore’s Green Data Center Roadmap

Previously thought to be a market that would not see much growth due to the moratorium, the government has surprised the industry with the announcement of the Green Data Center Roadmap, which allows an additional 300 MW to be added to the market if the proposals align with the government’s desired outcomes. This roadmap pushes providers and other stakeholders, such as equipment providers and end users, to seek more sustainable methods of operation. Applicable methods include retrofitting and installing more efficient processing and cooling equipment, increasing operating temperatures, and exploring alternate sources of sustainable energy.

Heavy investment in AI, cloud, and digital infrastructure

Cloud giants AWS, Google, and Microsoft have announced investment plans to establish their cloud regions and AI data centers in various markets across APAC, such as Tokyo, Singapore, Johor, Jakarta, and Bangkok. These investments amount to at least USD 45 billion in the region, with an even greater impact on local GDP. Local governments have also increased investment in their digital infrastructure to support the ever-increasing demand. In April, the Japanese METI (Ministry of Economy, Trade and Industry) announced measures to avoid dependence on foreign technology and cloud service providers, including an investment of JPY 72.5 billion (USD 470 million) in domestic tech firms to develop AI supercomputing resources, as well as the designation of cloud programs as Specified Critical Products. Similarly, in Malaysia, the SIDEC (Selangor Information Technology & Digital Economy Corporation) is working with partners to launch an IC Design Park in Puchong, elevating the country’s position in the semiconductor supply chain. These investments also contribute to the local economy by upskilling the workforce, increasing employment opportunities, and upgrading local digital infrastructure.

Looking Forward

Newer APAC markets have experienced immense growth due to digital transformation, incentives from strong governmental support, and data protection regulations that require sensitive information to be housed within the country. For instance, Indonesia is committed to digitalizing all government systems to achieve higher efficiency. This is being done by constructing four national data centers, also known as Pusat Data Nasional (PDN), with the first one in Bekasi already operational. Thailand's BOI (Board of Investments) has approved USD 291 million worth of data center-related investments as of 2Q 2024. With governments acknowledging the importance of a digital economy, more regional and global players are expected to enter the markets due to the attractive incentives. This also puts pressure on the procurement of more green energy and improved technology to achieve sustainability goals.