By Luke Smith · 1/5/2016

One of datacenterHawk's most-used online tools is Hawk Search. Data center professionals use this simple yet powerful way to find colocation, cloud, or land site solutions anywhere in North America, then make strategic decisions based on our real-time data.

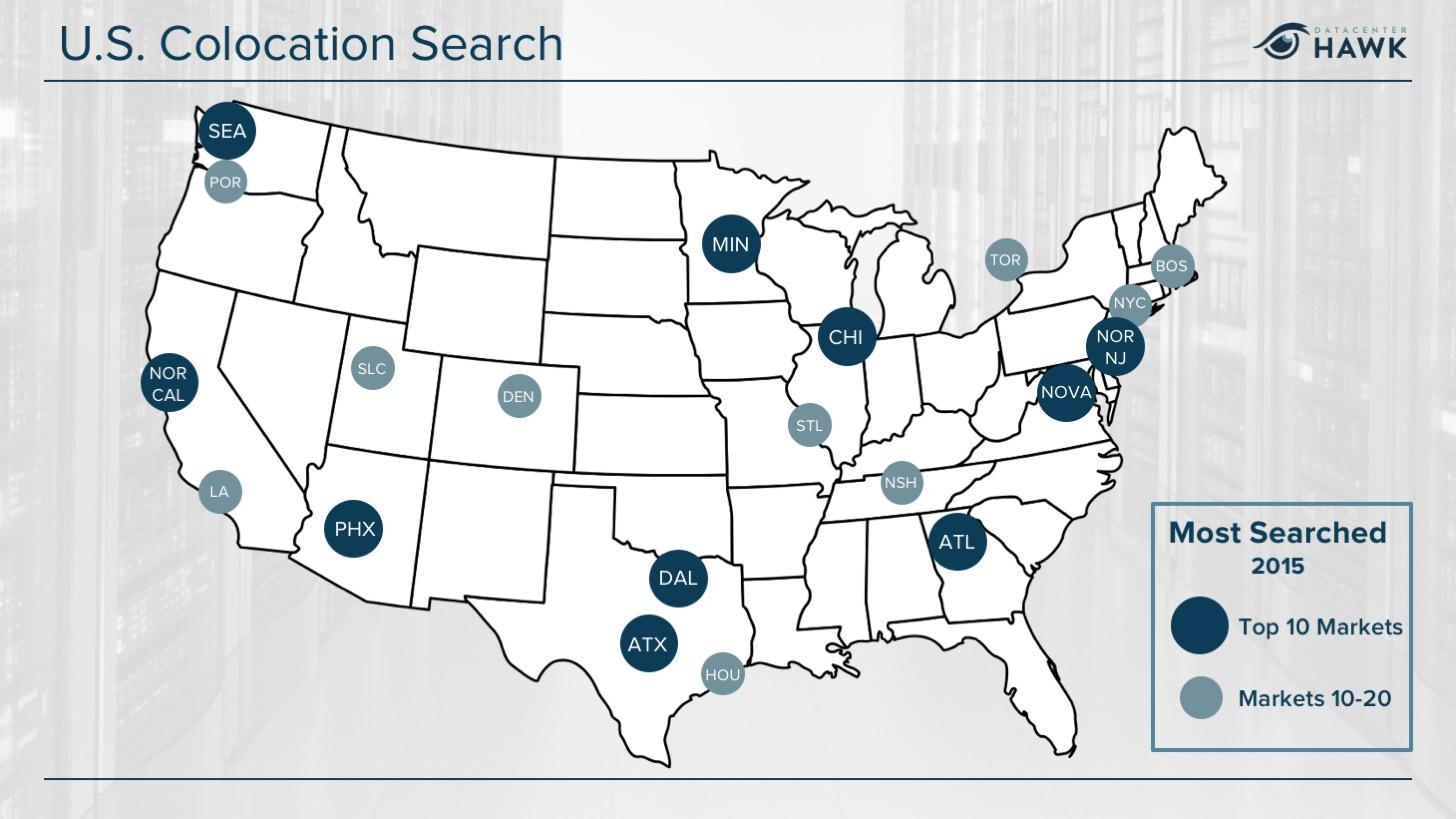

Throughout 2015, we analyzed how data center professionals used Hawk Search on our platform to find colocation solutions throughout the United States and Canada. The map below shows the top 20 most searched colocation markets for 2015:

Several interesting trends are seen in analyzing the 2015 search data:

Primary markets capture search majority – Large metros account for most colocation search today. Pretty intuitive, but let's dive deeper:

- Atlanta, Chicago, Dallas, Northern California, Northern New Jersey, Northern Virginia, Phoenix, and Seattle captured a majority of search for 2015.

- Data center users tend to migrate toward larger cities for several reasons:

- Competitive Colocation/Cloud Environment

- Reasonable Power Cost

- Robust Power and Communications Infrastructure

- Proximity to Other Business Locations

- Favorable Taxes/Incentives

- The big markets are getting bigger. Major supply is being added toNorthern Virginia (currently 426 MW), Dallas (currently 270 MW) and several other primary markets as well. Larger providers have doubled down in key markets, including Digital Realty, DuPont Fabros, and Equinix in Northern Virginia as well as QTS and RagingWire in Dallas.

- Large transactions land in Primary Markets. The majority of companies with large colocation transactions find a home in the big cities. Larger colocation transactions find value on campuses that can either quickly accommodate the power need or provide the user an option to control their own building.

Secondary markets still churning – The cities ranked 11-20 on our list received a strong amount of interest as well. A couple of quick takeaways:

- These secondary markets typically attract smaller transactions (250 kW – 1 MW) from companies that are in region. Occasionally, companies with larger requirements evaluate and head to secondary markets, as was the case with Infomart Data Centers landing LinkedIn earlier in 2015.

- Minneapolis in Top 10 for 2015. Why did Minneapolis land in the Top 10 most searched markets in 2015? Over the past few years, several data center providers (Stream Data Centers, Compass Data Centers, ViaWest, and DataBank) invested heavily in the market. Minneapolis is home to many Fortune 1000 companies that typically have larger data center requirements, and the Minneapolis data center market now provides a compelling reason to house a company's IT infrastructure in the region.

- Austin in Top 10 for 2015. While this might be surprising, Austin's tech growth and its proximity to Dallas has increased interest and activity on our platform.

- Denver rising. Denver averaged in the Top 20 for 2015, but cracked into the Top 10 in Q4. Denver is home to CoreSite, ViaWest, and FORTRUST, and several other providers (e.g. CenturyLink, Stream Data Centers, and zColo) have a strong in-market presence there. The Denver market is increasingly becoming a tech hub with a well-educated workforce and central location for data centers.

Canadian markets maturing and users are noticing – Canadian colocation markets are continuing to gain traction. Here's why:

- Toronto and Montreal are consistently searched on our platform as well, and it's our prediction this Northern market evaluation will continue.

- Canada's recent data center activity stems from both lagging supply as well as perceived data residency concerns, where companies avoid legal liabilities related to U.S. data privacy laws by storing data in Canada.

To sign up for a trial of datacenterHawk and get more information about data center markets, providers, and industry leading tools, register at https://www.datacenterhawk.com/register.