By Luke Smith · 5/7/2024

Across the globe, data center vacancy continues to trend downward. Delivery timelines are much longer than they were five years ago, meaning it takes more time for new capacity to come to the market. Furthermore, the scale of demand often results in large pre-leases of entire buildings and campuses before they’re delivered, limiting the amount of vacant supply coming to the market. For the global market in 2023, over 13 MW was pre-leased for every 1 MW of fully-delivered capacity absorbed. With the demand anticipated to come in the near future, it’s likely the discrepancy will be even wider in 2024.

North American Data Center Markets

Atlanta, Chicago, Dallas, Northern Virginia, and Phoenix are the largest colocation markets in the US, by far. While this has long been true for Chicago, Dallas, and Northern Virginia, Atlanta and Phoenix’s growth in recent years is noteworthy. In the last five years, Atlanta and Phoenix have doubled their portion of the market share. Within the last year, however, these five markets had exceptional growth. Between 1Q’19 and 1Q’23, these markets gained slightly over 5 percentage points of the total market share combined, from roughly 69% rising to 74%. In the last year alone, that share grew 8 percentage points, from 74% to 82%. This is attributed to the growth in Atlanta and Phoenix, as well as some plateaued growth in other major markets.

North American Market Share Percentage Over Time

Notable Trends & Markets

AI trend coming to fruition

While AI emerged into the data center industry in 2023, the impact it would have on demand and development remained unclear. In 2024, much of that demand was realized, even if on a scale yet to be seen in full. A large portion of absorption in 1Q’24 can be attributed to AI deployments, both from large tech companies and newly formed organizations dedicated to AI. Despite the significant amounts of capacity these newly-formed AI companies are leasing, many providers are still wary that they present a higher-than-average credit risk.

Skilled labor shortages impacting delivery timelines and new market candidacy

Data centers are highly technical structures and require specialized skilled labor for development. While the pool of skilled labor fit to develop data center space is large, demand for development is outpacing its labor force. As a result, some markets that would be an attractive candidate for development are now passed over due to lack of a qualified workforce. Companies also run into obstacles in relocating skilled labor to some markets, particularly if their project is short-term. While this is not a new phenomenon, it’s impacting markets that historically have had no issue with skilled labor shortages.

Looking Forward

Although vacancy is near historical lows, it’s likely 2024 absorption will exceed 2023. Year-over-year, absorption in 1Q 2024 in North America is up 71%. Absorption in the first quarter is equal to 40% of all absorption in 2023, and nearly as high as all absorption in 2022. With record spending by cloud service providers on AI-related infrastructure and the continued maturity of “AI-only” companies, expect demand to remain strong through 2024.

Latin American Data Center Markets

Between the eight primary LATAM markets, over 175 MW of absorption occurred in 1Q’24, bringing the region’s total to nearly 1,000 MW of total commissioned power. The primary benefactor of much of this capacity was São Paulo with a 29% uptick since the previous quarter. Santiago followed with 28% growth. A large percentage of the absorption is made up by pre-leased capacity that has already been committed even if the facilities are not completed. Planned capacity for the region is 2 GW with 600 MW of that capacity in Querétaro where power constraints don’t seem to be improving and an upcoming Presidential election this June is slowing decisions.

Notable Trends & Markets

Power constraints halt market growth

Querétaro power constraints continue with some providers reporting their projects are completely stalled. To expedite the delivery of power infrastructure, some providers are paying a premium of US$1 million per MW built by a CFE subcontractor from the substation to the park. As a result, some providers are now considering land with power outside of the Querétaro region to try to move forward with future projects.

Quarter over Quarter Market Growth in Querétaro

São Paulo topping the LATAM region with over 400 MW of commissioned power

Latin America has a total inventory of 1,150 MW of commissioned power distributed throughout the various colocation and hyperscale data centers in the region. São Paulo continues to be the regional leader with over 400 MW of commissioned power and nearly 600 MW of additional capacity either under construction or planned for future development. Overall absorption for the top eight markets was up 22% in Q1 over the previous quarter, making it the largest quarterly absorption ever in this region.

Looking Forward

Providers are experiencing the necessity of weighing a market’s strategic value and its power availability. While some are willing to wait for power to come available, many others are instead opting to go to markets with power, even if other characteristics of that market are less favorable. In Latin America, São Paulo continues to lead the region in data center development with 47% of the regional commissioned power and 27% of the planned capacity. Brazil’s government has for the most part embraced data center development as well as renewable energy efforts that will allow them to lead the region for the foreseeable future.

European Data Center Markets

For the third quarter in a row, over 250 MW of absorption occurred between the major European markets. Despite power challenges in most markets, opportunities for new leasing remain. Most activity centered around Frankfurt, which is quickly becoming the largest market in Europe. Despite power challenges, Frankfurt has grown by nearly 350% over the last four years.

FLAPD Market Share in 1Q 2020 Compared to 1Q 2024

Notable Trends & Markets

Development looking to the East

In response to rising demand from clients to be in Eastern Europe and a lack of power in Western Europe, many providers are seeking opportunities to expand eastward into countries like Poland, Hungary, and Romania, as well as down toward Greece and the greater Balkan area. These regions are attractive for large cloud companies as they seek to improve their geographic diversity and offer improved products to previously limited markets. AI deployments are also interested in these regions due to their availability of power.

Multiple new projects bolstering future supply in Amsterdam

Planned power in Amsterdam jumped by nearly 50% during the first half of the year. This is due to several new projects coming to Amsterdam from providers like CloudHQ and Switch Data Centers. Compared to other European markets, Amsterdam’s growth is subdued, due primarily to moratoriums and power constraint issues. As these problems are sorted out, new opportunities are arising for development. The Netherlands is also exploring additional solutions for power generation to boost its overall supply, potentially easing some development restrictions.

Looking Forward

Power supply issues have limited growth in major European markets, though a wave of new land purchases are positioning the region for substantial growth in the future. While the timeline of delivery for these projects will be longer than before, providers are confident in their ability to procure power and develop new space to meet the large-scale demand for data center capacity in Europe.

Asia-Pacific Data Center Markets

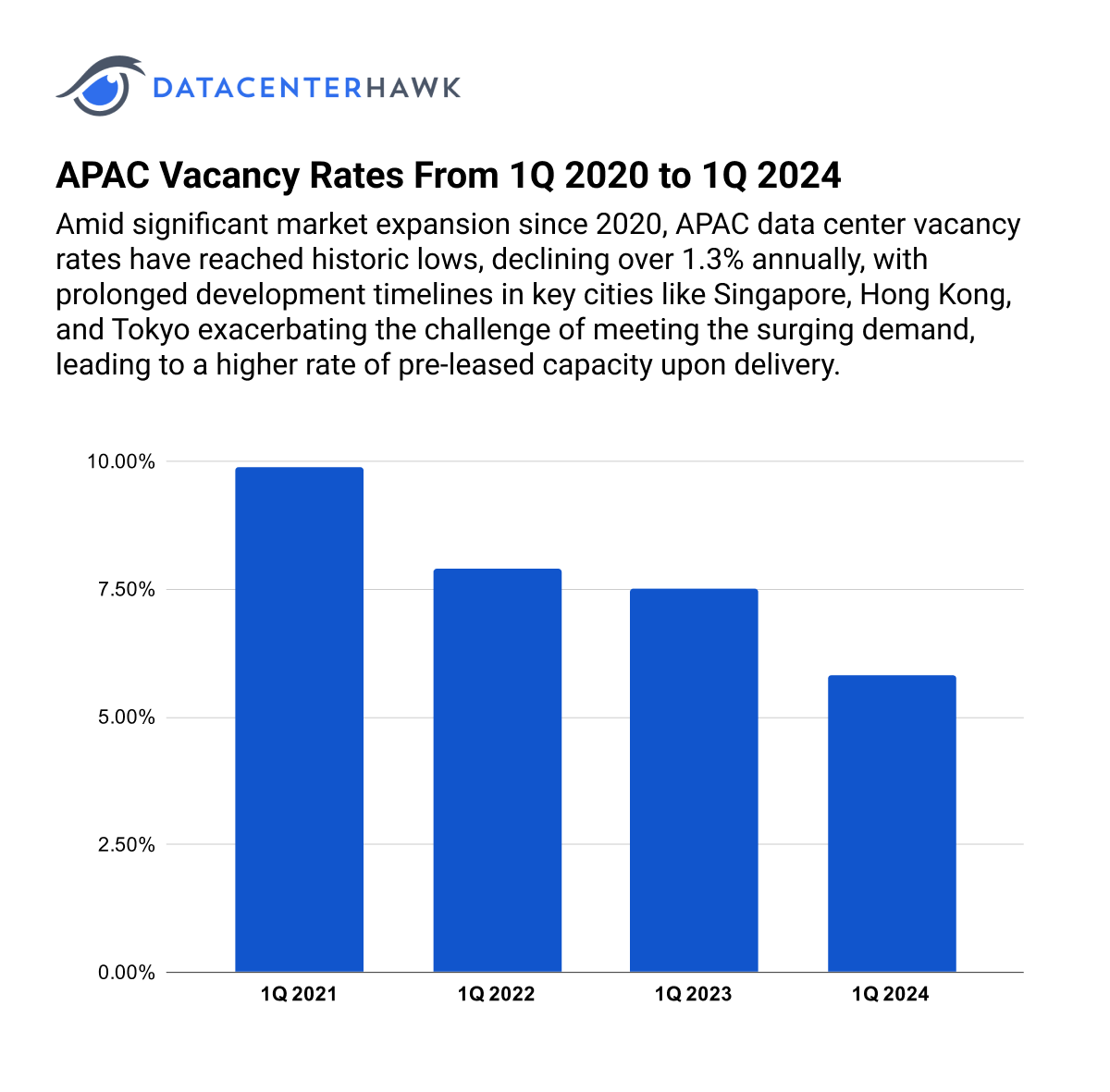

Despite substantial growth in major markets since 2020, including some speculative development, vacancy rates in APAC are at their lowest point, dropping by an average of more than 1.3% annually. Development timelines in major cities like Singapore, Hong Kong, and Tokyo are historically lengthy, even prior to pandemic-related supply chain issues. This makes it difficult for new supply to come to the market quickly enough to flatten vacancy decline. As a result, more capacity is pre-leased upon delivery and vacancy drops further.

APAC Vacancy Rates From 1Q 2020 to 1Q 2024

Notable Trends & Markets

Japanese data center industry shifting focus to accommodate international demand as wholesale and hyperscale requirements increase

In addition to the familiar international players, the Japan data center market comprises many domestic colocation, wholesale and cloud service competitors with diverse corporate backgrounds such as telecom, technology conglomerates, IT services, system integration, software, trading-company IT subsidiaries, and others. As the scale of development grows to meet hyperscale demand and the participation of multinational competitors grows, we may see shifting strategy among the domestic players. For example, under activist investor pressure, local technology giant NEC is considering the sale of its data centers to focus on its core businesses. In a very different move, Japan’s (and one of the world’s) largest data center operators, NTT Group, is creating a JV with TEPCO Power Grid, Inc. to leverage each’s expertise to develop and operate hyperscale data centers in the Inzai-Shiroi area, one of the key centers of hyperscale development in the Tokyo market.

AI demand boosting development in APAC

There are multiple markets emerging in APAC that are attracting hyperscale development due to large quantities of power and undeveloped land. While many markets can support large-scale development, Johor also stands out as a favorable option for AI deployments. A decent portion of the market’s absorption over the last few quarters can be attributed to AI. The region is a cost-favorable option while also leveraging the connectivity and data center expertise available in Singapore.

Looking Forward

Like many other regions, demand is spreading out in APAC. While this results in new emerging markets throughout the region, there are also new submarkets sprouting around existing primary markets. This has contributed to the growth of the Johor market, and is evident in Japan. Although the vast majority of hyperscale development remains focused on the Tokyo and Osaka markets, some developers are looking to areas farther afield, with significant developments announced in Hokkaido and Hiroshima during the past two quarters. Drivers for such projects are mitigation of natural disaster risk, government incentives, power availability, and the explosive growth of AI.