By Luke Smith · 11/12/2024

North American Data Center Markets

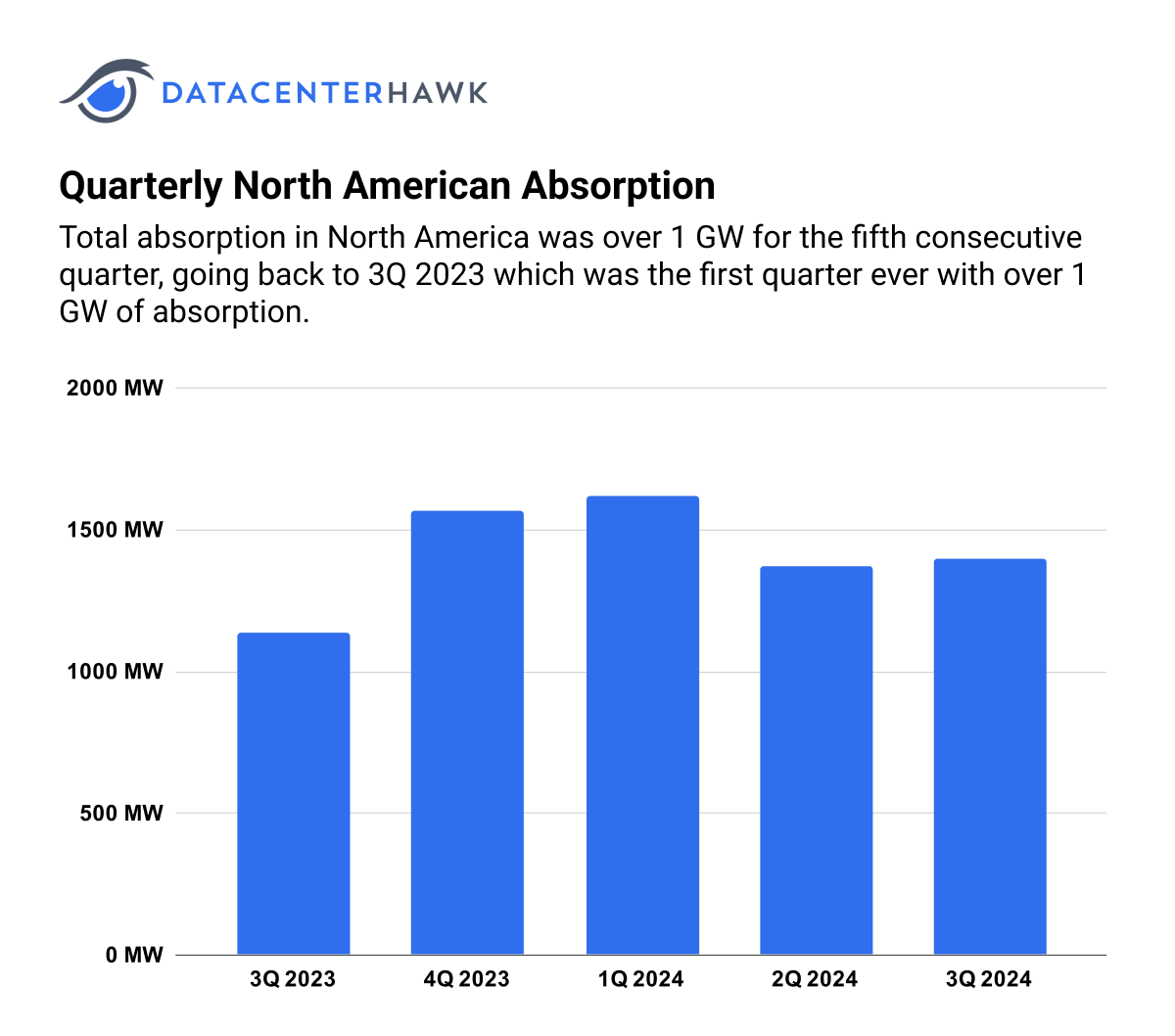

Total absorption in North America was over 1 GW for the fifth consecutive quarter, as multiple, campus-sized leases were signed in 3Q 2024. While the bulk of leasing still remains in major metros, requirements are considering and committing to many emerging markets or untapped regions.

Quarterly North American Absorption

Notable Trends & Markets

AI requirements lead to the creation of new submarkets and adoption of alternative energy sources

Providers and users are evaluating and adopting alternative solutions to power delivery timelines. In markets like Chicago and Dallas, new submarkets like Yorkville, IL, Will County, IL, and Fort Worth, TX respectively are seeing increased attention. Additionally, there has been an increased focus on the nuclear power as a solution to increase power generation in the form of recommissioning nuclear sites and building newer small modular reactors (SMRs). While nuclear power has extended timelines to bring power online, natural gas cogeneration turbines as being evaluated and implemented to help bridge power.

Emerging markets seeing hyperscale leasing and activity

Secondary markets, some of which have recently had a disproportionate amount of planned data center capacity to commissioned data center capacity, have realized the investment as secondary markets accounted for 2 of top 5 markets in terms of leasing in 3Q 2024. Hyperscale users have also expanded their owned and operated presence in nontraditional data center markets/regions like the Midwest and South through construction and land acquisition.

Looking Forward

While power availability may remain at the forefront of delivery concerns, adaptive reuse developments are becoming a favorable alternative to extended power delivery timelines. Former industrial sites with existing power infrastructure provide an option for providers and users to potentially bring bridging data center capacity to the market sooner.

Latin American Data Center Markets

Latin American countries are deviating in separate directions in respect to foreign investment, energy infrastructure, and data center development. Some countires see the benefits and are creating policy at the national level to try and attract foreign investment, develop a competitive energy framework, incentivize renewable energy generation, and offer long term economic security. On the opposite side there are countries that have the potential to be the regional leaders in data center development but national politics, limited infrastructure, and a lack of knowledge will drive development elsewhere.

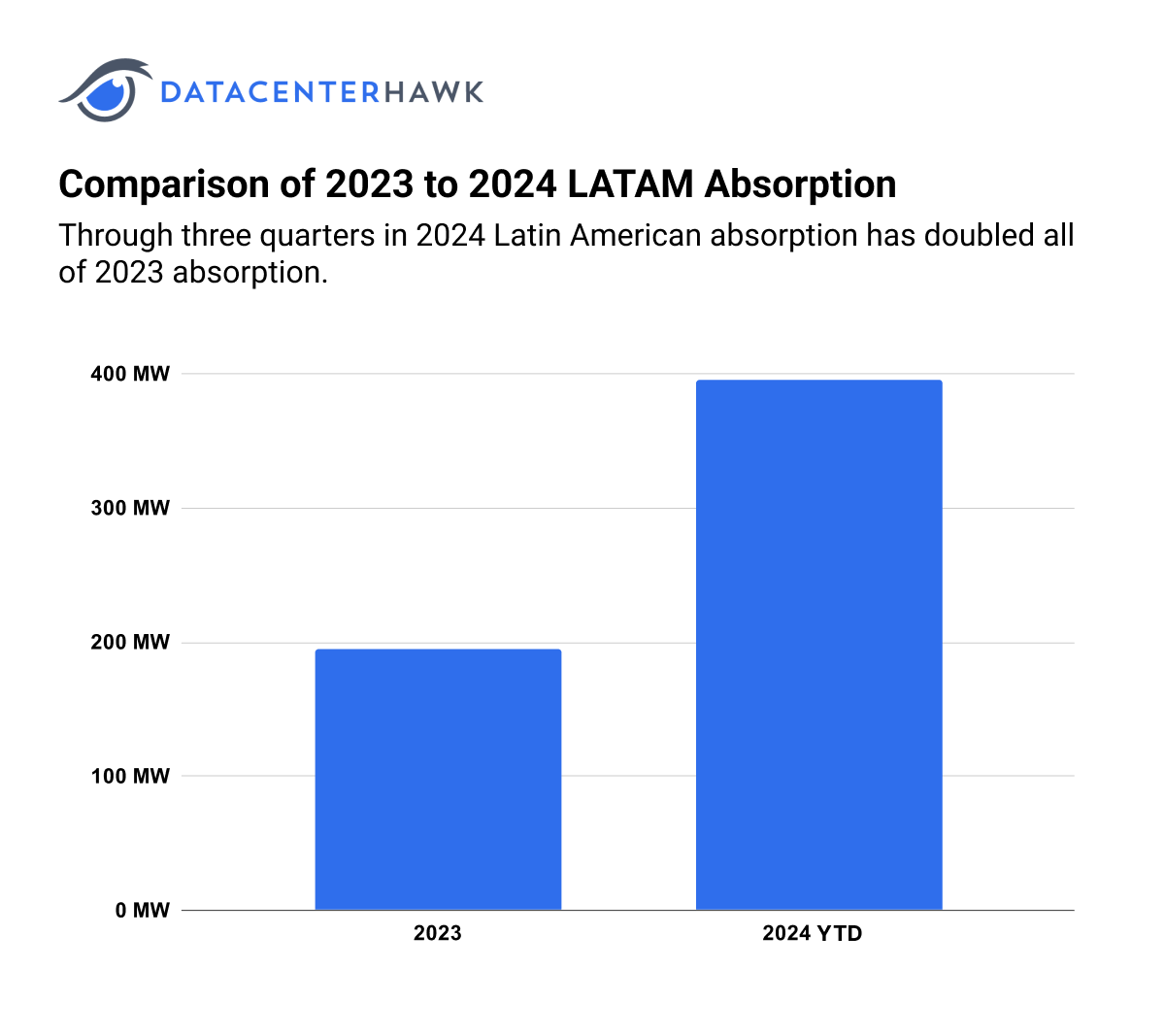

Through three quarters in 2024 Latin American absorption has doubled all of 2023 absorption. Sao Paulo continues to be the regional leader with just under 500 MW of commissioned capacity, but Queretaro had the most individual market absorption in 3Q due to a large hyperscale pre-lease.

Comparison of 2023 to 2024 LATAM Absorption

Notable Trends & Markets

Hyperscale spread outside of Sao Paulo

The Northwest region of Campinas, outside of Sao Paulo, is quickly becoming the epicenter for new hyperscale self-builds as well as several built to suits for hyperscale customers. The area comprised of Paulinia, Sumare, Hortolandia and now Limeira has seen an increase of land purchases and construction the past year. The most likely reason is abundance of power and lower land costs which are about $32/sqm vs. downtown Sao Paulo where they can be more than $500/sqm. Microsoft announced in September that it would invest US$2.7B in cloud and AI infrastructure over three years. Further to the south in the State of Rio Grande do Sul, Scala intends to develop the 4.75 GW Scala AI City campus. Scala has acquired 700 acres for this AI city, 32 km outside of Porto Alegre. When complete, it is estimated to cost US$50B but with an initial investment of US$500 and 54 MW.

Multiple retail providers shifting focus to hyperscale

Several Latin American based data center providers are refocusing some of their new builds to go after the hyperscale wave that has hit the region. Data center providers like Equinix (via xScale), KIO, Elea, Cirion- that traditionally offered retail colocation are now expanding their reach into this segment. In the past few months several other retail providers seem to be joining the fray- V.Tal, Nextstream, Takodo- all best known for their retail facilities throughout the region have been purchasing land to plan hyperscale builds.

Argentina RIGI Reform Bill Approved to Incentivize Investment

The administration successfully passed the RIGI (Regimen de Incentivos para Grandes Inversiones) reform law that provides generous tax, trade, and foreign exchange benefits for 30 years when investments surpass US$200M. Cirion recently announced that they had purchased land in Pilar, North of downtown Buenos Aires to build a 20 MW facility and are evaluating submitting under the RIGI campaign. Other data center providers are evaluating Buenos Aires as it offers some of the lowest land and energy prices in the region and Latin America’s third largest economy.

Looking Forward

Latin America digital infrastructure is poised for impressive growth in the coming years, but it is imperative to focus on making the right investments to support this growth. A common discussion topic is how to land AI requirements in LATAM markets with little focus on the underlying infrastructure that is required to support the 100 MW+ AI deployments that are being announced in other regions. Markets that establish the underlying infrastructure and incentives will be rewarded with investment inflows.

European Data Center Markets

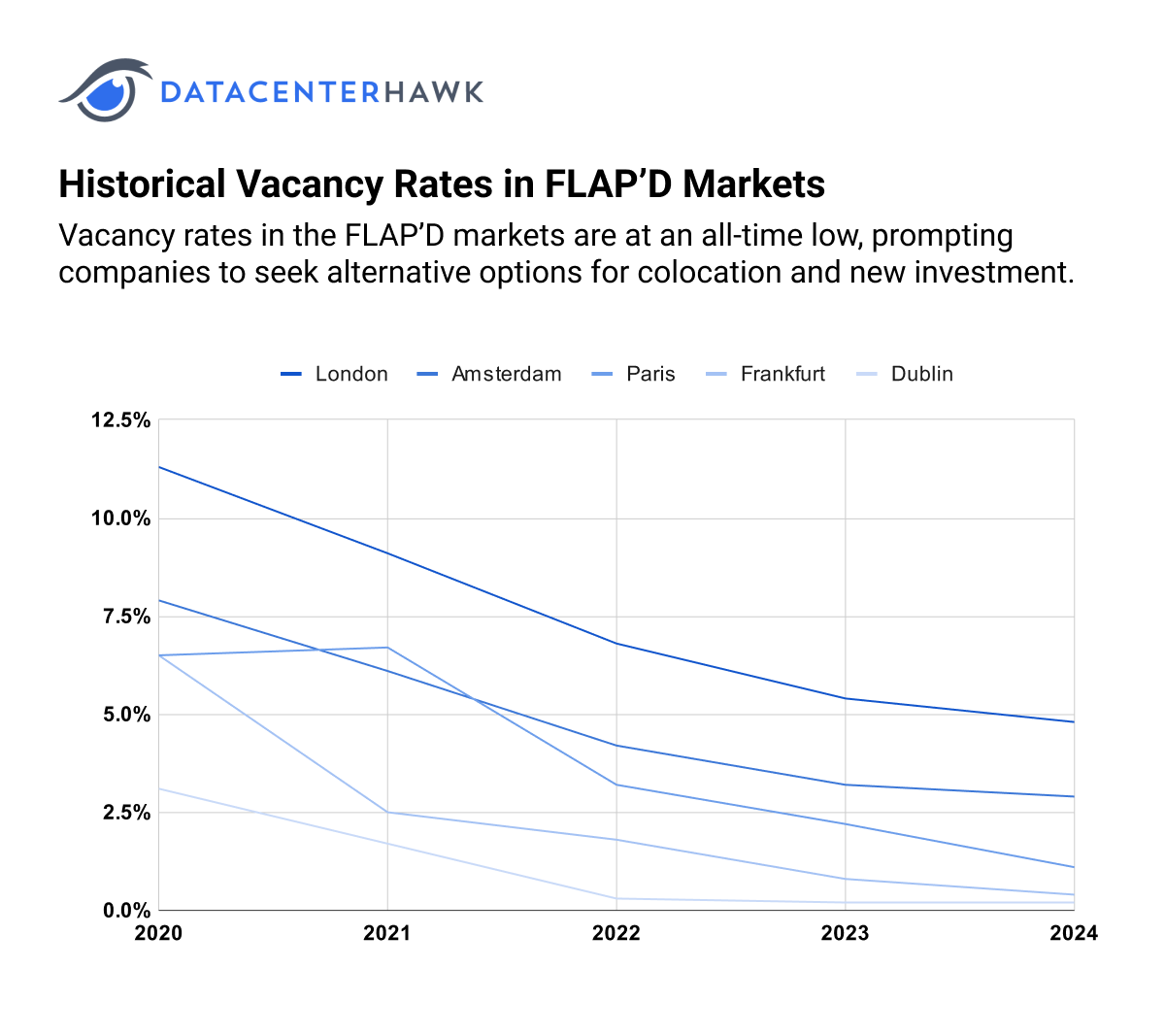

Apart from London, market activity in the traditional strongholds of FLAPD cities was subdued in 3Q. Of the nearly 150 MW of absorption in major markets, London accounted for nearly 75%. The geopolitical situation and lack of space and power capacity in the major data center hubs in Europe means that absorption and vacancy rates are generally low. The average vacancy rate among the FLAPD markets is 2.2%, with some markets under 1%. Retail colocation space in all markets is scarce and the focus has shifted to hyperscale build-to-suit projects with entire data centers being leased before construction has even started. This is resulting in long lead times for customers to get access to their data center capacity.

Notable Trends & Markets

The Future of Data Centers in the FLAP’D Markets: Scarcity Challenges and Hyperscale Development Responses

The FLAPD markets are experiencing very limited land and power availability, creating significant challenges for data center expansions and new market entrants. In these countries, regionalization is becoming a strategy for addressing these challenges. For example, QTS has announced 1.1 GW in Northumberland, Northern England, while Echelon has announced a 200 MW facility in Wicklow, south of Dublin. Additionally, the company Humber Tech Park Ltd announced a 386 MW site in Humberside, Northeast England and an 80 MW facility has been granted planning permission in Newham, East London. A similar spread to multiple cities throughout a country is seen in Germany and Spain. Cheaper land and access to power and fiber is driving the development of secondary and even tertiary markets in these countries. In some territories, stand-alone data center developments with no other data center ecosystem around them are emerging.

UK government reclassifies data centers as Critical National Infrastructure

In a positive move, data centers in the UK were registered as Critical National Infrastructure by the UK government. This means that data centers and operations staff have a higher security status and a level of protection as part of the infrastructure that is critical to the operation of the nation. It also means that central government can step in to speed the planning process for new developments, but this will come with a higher level of government scrutiny for the industry in the UK.

Tier 2 and Tier 3 data center markets boom

Considering the energy availability challenges in the FLAP'D markets, data center providers are increasingly shifting their focus to Tier 2 and Tier 3 markets, such as Spain, Italy, and Greece. Particularly in Madrid, Milan, and Athens there is a significant surge in activity due to easier access to energy at lower costs and higher vacancy rates compared to the FLAP’D markets, along with shorter lead times for deployment. These three countries are emerging as critical data center hubs in Europe, with announcements of major deployments in the region.

In Spain, the energy company Solaria, in partnership with the Japanese Datasection, has announced plans for a 200 MW data center in Madrid. Meanwhile, EDGNEX a subsidiary of the Emirati conglomerate DAMAC, has announced a €400 investment to build a 40 MW data center in the Spanish capital. Additionally, Iberdrola has established a subsidiary that aims to develop a data center with a capacity of 1.2 GW by 2030 in Bilbao. The Aragón community, particularly Zaragoza is becoming very attractive for investment, hosting hyperscale deployments from AWS and Microsoft. Recently, QTS announced a €7.5bn investment to build a 300 MW data center in the Aragón community. This region has 22 GW of approved capacity with a goal of reaching 30 GW by the end of the decade. Aragón also has a surplus of renewable energy and over 90 interconnected substations, making it a great option for hyperscale data center development. The local government offers legal instruments to expedite strategic investments, along with tax incentives and other support mechanisms to promote data center growth in the region.

In Italy, Microsoft has announced a €4.3bn investment to expand its cloud and AI data center infrastructure in the Lombardy region, positioning Italy to become one of Microsoft’s largest data center regions in Europe.

Moving on to Greece, its strategic position in the Mediterranean Sea, linking Europe with Africa, Middle East, and Asia, makes it an attractive destination for data center investments. Athens is the country’s main hub but the island of Crete also stands out due to its proximity to major submarine cable routes connecting these regions. Data4 recently announced a 90 MW data center in Athens, while Apto announced a €300 million investment to build a data center in the Greek capital.

Looking Forward

The data center market continues to grow in Europe but the traditional strongholds FLAPD are slowing. New markets are continuing to open with developments throughout southern European countries and the Nordic region. AI and HPC workloads are driving the demand with large power capacities required to support these installations. This pattern is set to continue throughout the region. Pricing is also due to increase due to rising construction materials and costs, new technologies such as liquid cooling, and GPU power infrastructure. The shortage of available data center capacity will also lead to increased demand for those companies who can deliver large scale developments in the timescale that is acceptable to the clients. This will also lead to higher prices for the industry.

Historical Vacancy Rates in FLAP'D Markets

Asia-Pacific Data Center Markets

The APAC data center market is witnessing significant growth, driven by the escalating demand for cloud services, big data analytics, and digital transformation across various sectors. Data centers are becoming an asset class that investors find highly attractive and are watching closely. Most countries welcome the influx of new investment as opportunities to develop the local digital economy and improve their digital infrastructure. However, there are concerns about limits on land, power, water, and sustainability. The shift towards greener data centers has pushed providers to sign more PPAs and experiment with energy-efficient management systems and equipment. The pressing concerns of strains on energy and water provision in booming markets such as Johor and Seoul have also pushed governments to look at alternative locations for data centers. Since last quarter, more capacity has come online, which has increased vacancy rates for markets like Bangkok, Jakarta, and Johor. On the other hand, more mature markets like Sydney and Tokyo experienced elevated activity, and vacancy rates have dropped even lower.

Notable Trends & Markets

Australia remains path-of-least-resistance for APAC colo and hyperscale development

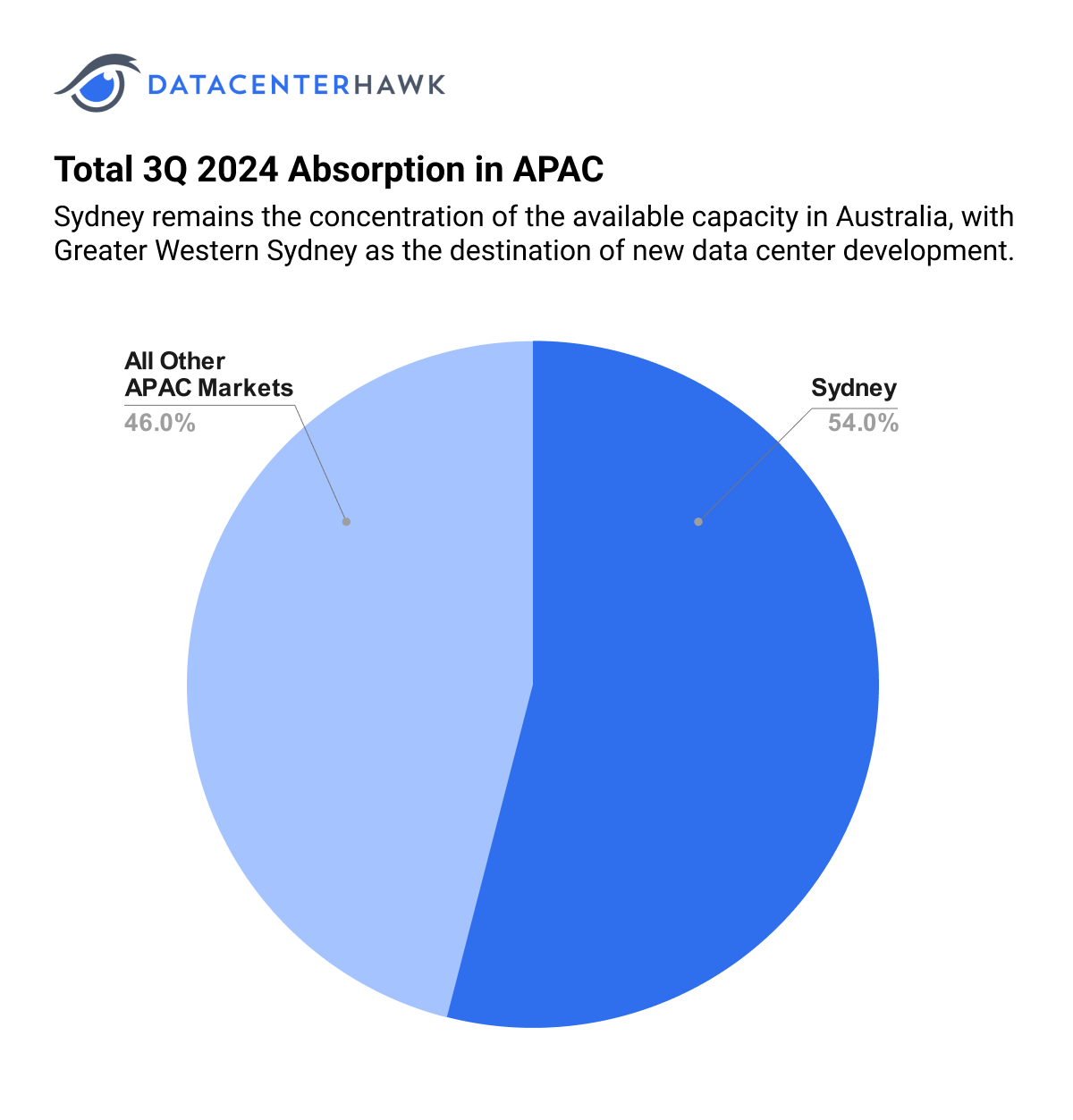

Total 3Q 2024 Absorption in APAC

Sydney remains the concentration of the available capacity in Australia, with Greater Western Sydney as the destination of new data center development. Suburbs such as Erskine Park, Eastern Creek, Kemps Creek, Macquarie Park, have been the choice of colocation providers (eg. Equinix, Digital Realty, NextDC ) as well as hyperscale self-built facilities (AWS, Microsoft). New constructions in this area incorporate advanced cooling techniques to support the eagerly anticipated AI infrastructure. Highlight this 3Q includes NextDC acquisition of AUS$353 data center site in Eastern Creek, which will be called S7. This site covers approximately 2.6 million SF and will deliver 550 MW of capacity when completed. The Global Switch Australia acquisition by HMC Capital has also been talk of the town, at time of writing the acquisition process is nearing completion and the data center will offer approximately 100MW to the market and operate under a new brand called DigiCo.

Melbourne data center market is also booming especially in the North/West Melbourne due to the availability of land parcels and power in those areas, formerly industrial areas. Suburbs such as Truganina, Derrimut, Port Melbourne, have become the destination for colocation providers (eg. Equinix, Airtrunk) as well as hyperscale companies (AWS, Microsoft ).

Governments in NE Asia continue to encourage data center developers to shift focus from large urban centers to alternative locations

In September in Japan, the first of two METI-subsidized AI data centers was opened in Fukushima, more than 200km north of Tokyo. AI Fukushima (subsidiary of Kyoto-based RUTILEA) has equipped its new data center with NVIDIA's H100 GPU and intends to build an easy-to-use AI development platform for AI developers. This is a small step in furthering the government’s goal of improving distribution of power demand and mitigating the risk of over-concentration of digital infrastructure in a natural disaster. In a related development, METI and the Ministry of Internal Affairs and Communications are planning to support the development of photonics-electronics convergence technology. This will allow data centers to handle enormous amounts of data while requiring much less power than conventional methods.

The South Korean government is also tackling similar issues. The Seoul Metropolitan Area (SMA) is home to more than half of the population of the country and the overwhelming majority of corporate headquarters. Recent data center supply growth has further centralized high-voltage power demand in the SMA. The government sees these developments as uneconomical and suboptimal. There is also considerable pressure from community groups who believe that electromagnetic radiation from transmission cables is a health hazard. In response, the Distributed Energy Act has been implemented, requiring submission of a Power Grid Impact Assessment (PGIA) for all new projects in the SMA of greater than 10 MW power consumption. This will add time and uncertainty to new plans and the government hopes that it will encourage more developers to shift their plans away from the capital.

Looking Forward

The data center market in the APAC region continues to thrive, with numerous large campuses set to launch in the near future. It is crucial for local governments to assess and guarantee that there is adequate support and a conducive environment for both existing and new investments. As there is a heavy emphasis on sustainability and greener data centers, newer markets will probably face more pressure to match the sustainability standards of more mature markets.