By Luke Smith · 4/29/2025

North American Data Center Markets

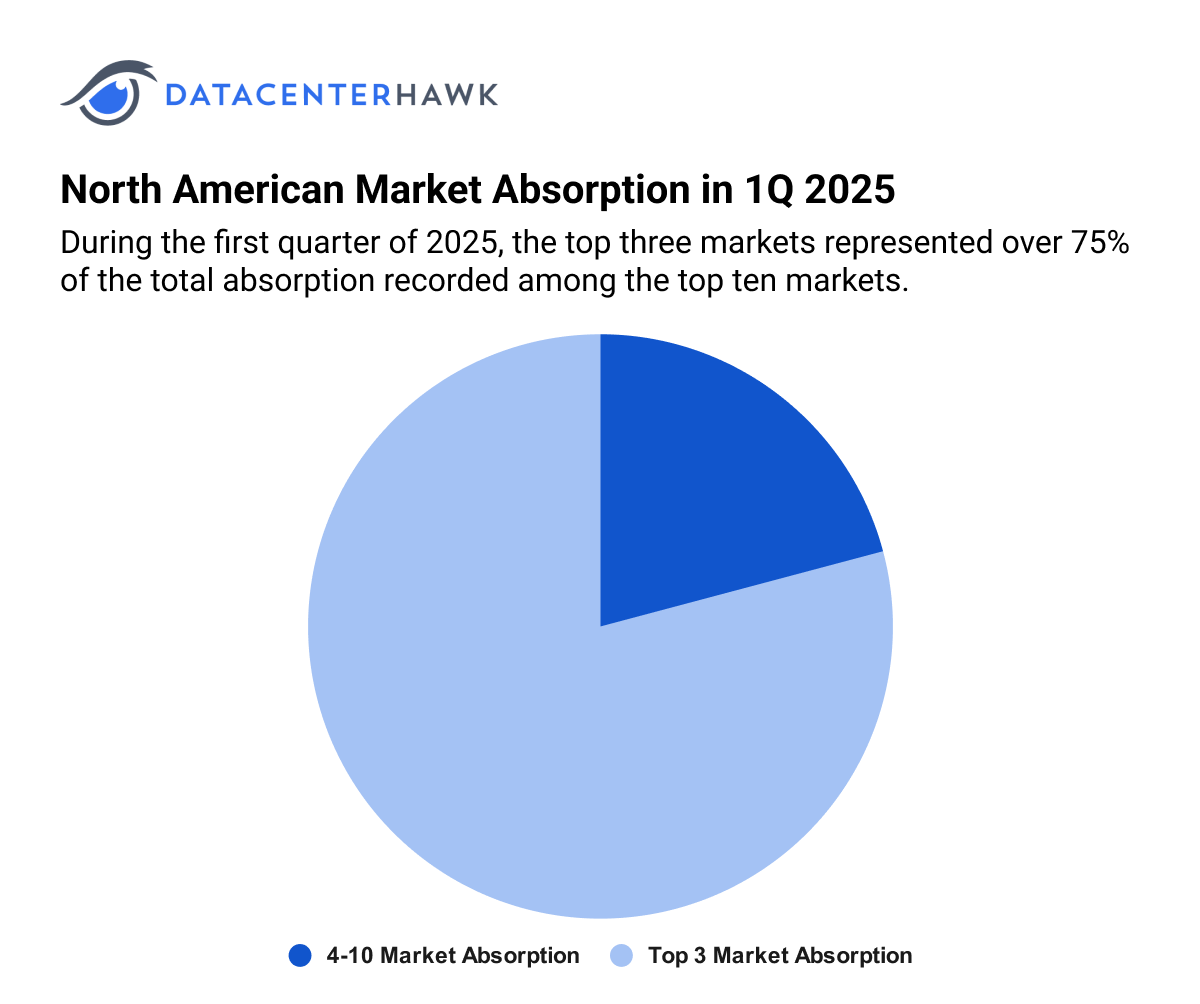

North American data center demand persisted in the first quarter of 2025, despite subdued leasing. This was due to a few hyperscale companies focusing on how they can intelligently leverage their CapEx budgets instead of their traditionally aggressive expansion plans. This slowdown in leasing allowed smaller enterprises to take most of the focus, with a number of deals being signed with SaaS companies, neo-clouds, large retail enterprises, and social media companies. While absorption metrics were lower than in the first quarter of 2024, this does not appear to be a demand signal but rather highlights the financial complexity of the current state of the market. Despite a temporary pullback by some large users, the North American data center market grew 40% year over year. With the total cost of ownership for data centers continuing to increase, power studies becoming more expensive, and speculation around looming tariffs, hyperscale users are thinking critically about how they evolve to boost efficiencies and reassess their market deployment strategies.

Notable Trends & Markets

Development focused on cities and suburbs adjacent to major colocation markets

Driven largely by AI workloads and the desire to bolster cloud regions, planned projects in the U.S. sprawled out from traditional core markets into submarkets outside more established data center hubs. Northern Virginia, the region’s largest data center market, showing 9.6 GW of capacity, continued to see development sprawl south toward Richmond, north of Core Ashburn to Martinsburg, WV, and across the Potomac to Frederick, MD. Providers are heavily scrutinizing their basis of design and refresh cycles, with many continuing to bifurcate between turnkey data center development and building and leasing powered shells.

Other Tier 1 markets like Atlanta (2.3 GW), Phoenix (2.8 GW), and Dallas (2.4 GW) continued to receive interest. However, much like Northern Virginia, utility limitations have created a bottleneck in delivering space and power. In Phoenix, activity persisted in Mesa, Goodyear, and Glendale, with water and power usage remaining top of mind for community leaders. In Atlanta, some providers leveraged their capital to shorten lead times for power delivery by covering the network upgrade costs associated with on-site substation development. Dallas continued to attract developers, largely due to ERCOT’s favorable Integrated Resource Plan, which includes a diverse mix of renewables and traditional power generation. Additionally, because the ERCOT ISO is not bound to many of FERC’s regulations, transmission infrastructure can often be expanded more quickly than in other energy markets. Power limitations and the high cost of doing business in states like California and New York have led to a lull in new market entrants planning large-scale development in those regions.

North American Market Absorption in 1Q 2025

Secondary and tertiary markets benefit from less power congestion

Providers hoping to develop projects without the encumbrance of power constraints have migrated away from Tier 1 markets to secondary and tertiary markets, with some low-latency LLM deployments occurring in remote areas not proximate to major metros or established data center markets. Challenges developers face in these “non-market” builds include labor shortages, limited housing, infrastructure constraints, and risks associated with the long-term underwriting of a data center’s value.

Tier 2 and 3 markets that continue to receive attention include Columbus, Reno, Kansas City, Charlotte, Denver, Las Vegas, and the broader Portland area. Richmond is emerging as an attractive region due to its proximity to subsea cabling and the continued southern sprawl along the I-95 corridor. West Texas has also seen increased land banking from providers hoping to capitalize on the abundance of natural gas power in the state, shortening lead times to RFS dates while awaiting network upgrades to deliver grid power.

Creative power strategies sidestep bottlenecks

Securing a viable path to power has created ripple effects throughout the industry. Providers seeking to secure utility power from the grid are facing increased upfront costs to complete a load study. Often, utility power is several years out and does not align with the speed-to-market that developers require to meet the needs of their clients. This has led to the adoption of natural gas bridging power solutions, behind-the-meter power generation, and early-stage exploration of nuclear energy. The emergence of alternative energy solutions has helped some companies deliver data center capacity more quickly, while also maintaining the sustainability targets of their organizations.

Looking Forward

Despite subdued leasing in some markets, it’s anticipated demand from cloud service providers, hyperscale users, and AI companies will remain constant across primary, secondary, and tertiary markets. Providers will continue to assess the rise in rack densities, the subsequent liquid cooling needed for these workloads, and how their forward-looking plans may need to be reevaluated to meet evolving industry demands. Secondary markets will likely experience substantial growth, with many providers following hyperscale users to new regions in an effort to win their business. Hyperscale and enterprise colocation deals will both continue to take place, with much of the planned capacity already being pre-leased by hyperscale users. There remains an opportunity for multi-tenant data center providers to leverage their existing inventory for enterprise users; however, with vacancy rates in many markets below 1%, optionality on the tenant side remains limited.

Latin American Data Center Markets

As international data center markets position themselves to support hyperscale AI training deployments, several U.S.-based hyperscalers are temporarily pausing new demand due to supply chain uncertainties, including new tariffs, the rollout of next-generation NVIDIA chips, and energy constraints in overdeveloped or less strategic areas. While Latin America is also experiencing some of this pullback, demand is increasing from Chinese cloud providers expanding into key regional markets like Mexico and Brazil.

Although Latin America accounts for only 2% of global data center capacity, it recorded 42% year-over-year growth in 2024—the fastest growth rate globally by percentage. To sustain momentum, countries like Brazil are reducing deployment friction by forming national data center associations, pushing for lower import tariffs on chips, streamlining permitting processes, and promoting their renewable energy advantages.

Notable Trends & Markets

New growth strongly tied to energy access

Energy access continues to be a major driver and constraint in the development of data center markets across Latin America. In Mexico, ongoing power shortages in Querétaro have significantly limited new deployments, prompting providers and hyperscalers to shift their focus northward to cities like San Miguel de Allende and San Luis Potosí, where energy access is more reliable. On the other hand, Brazil presents a stark contrast with an energy surplus that has allowed Brazil to export electricity to neighboring countries. Additionally, Brazil benefits from having 20% of the world's freshwater reserves, 94% of its electricity generation sourced from renewables, and a nationally interconnected electrical grid, which enhances the distribution of renewable energy generated in the northern regions of the

country.

Economic Challenges and Regulatory Barriers

Both Argentina and Brazil are actively working to attract AI infrastructure and investment by addressing economic hurdles and reducing market entry barriers. Argentina has taken notable steps by stabilizing inflation, launching the RIGI investment initiative, and removing currency controls that had been in place for over two decades - all aimed at opening the economy to foreign capital and digital infrastructure investment. Brazil, meanwhile, is grappling with high interest rates - currently at 14.25% and projected to rise to 15.5% by the end of the year. More critically, Brazil’s import tariffs on IT equipment and GPU chips can exceed 60%, creating a significant barrier for AI deployment. Reducing these tariffs is seen as essential to keeping Brazil competitive in the global race for AI and data center expansion.

Next-Generation Subsea Cables Will Unlock LatAm’s AI Potential

Advanced cloud and AI capabilities depend on high-capacity global connectivity. Historically built by telecom operators, deep-sea cables cost around $40,000–50,000 per kilometer, and their capacity was resold at premium prices. In the past decade, hyperscalers like Google and Meta have begun deploying their own systems, citing aging infrastructure and cost inefficiencies. Today we have several hyperscale systems connecting Chile, Brazil and Argentina to the U.S. but have also see announcements from Google for the Humboldt cable that will interconnect Chile to Australia and Meta’s Project Waterworth, the world’s longest subsea cable that will land in Brazil, U.S., India, South Africa and other key regions. These investments will enhance regional cloud resilience and support long-term AI deployment.

Renewables at the Center of the Strategy

While hydroelectric power dominates Latin America’s energy matrix, droughts have exposed the need for diversification. To that end companies like Amazon are investing in a 122MW solar farm and a 50 MW wind farm in Rio Grande do Norte. OData is working with Atlas Renewable Energy to transition their data centers to renewable energy. In Brazil a provider can has a greater chance of consuming renewable power purchased from a wind farm on Fortaleza for a data center in Sao Paulo due to an interconnected grid. This is unlike the U.S. market where a data center provider will purchase RECs (Renewable Energy Certificates) that was generated in another state and this electricity will never reach the providers data center.

Looking Ahead

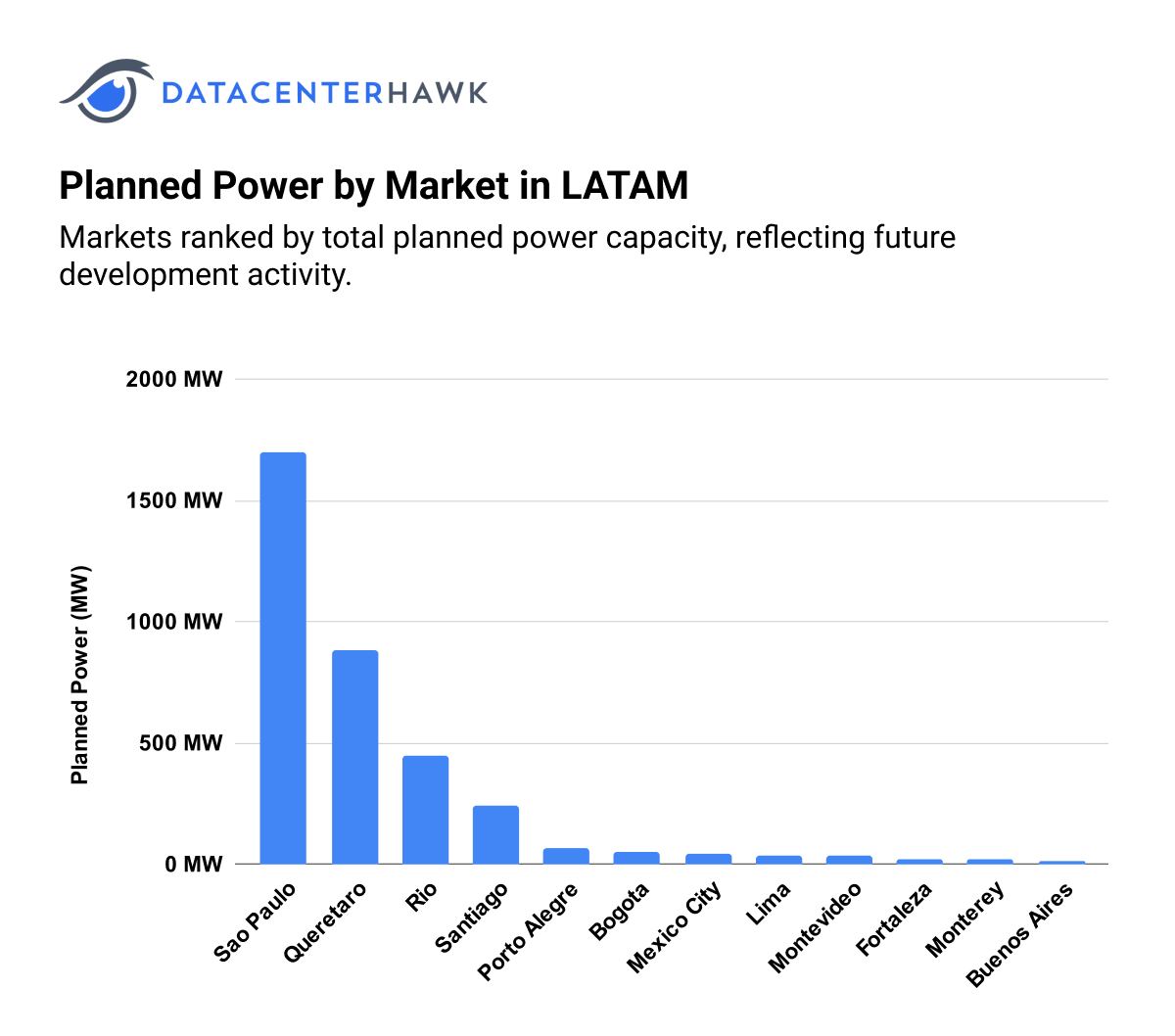

Planned Power by Market in LATAM

Although the pace of absorption slowed in Q1 2025 following record activity in 2024, the outlook remains strong. A projected 3.5 GW of capacity is in development across the region, positioning Latin America for a rebound in demand and continued long-term growth in the second half of the year.

European Data Center Markets

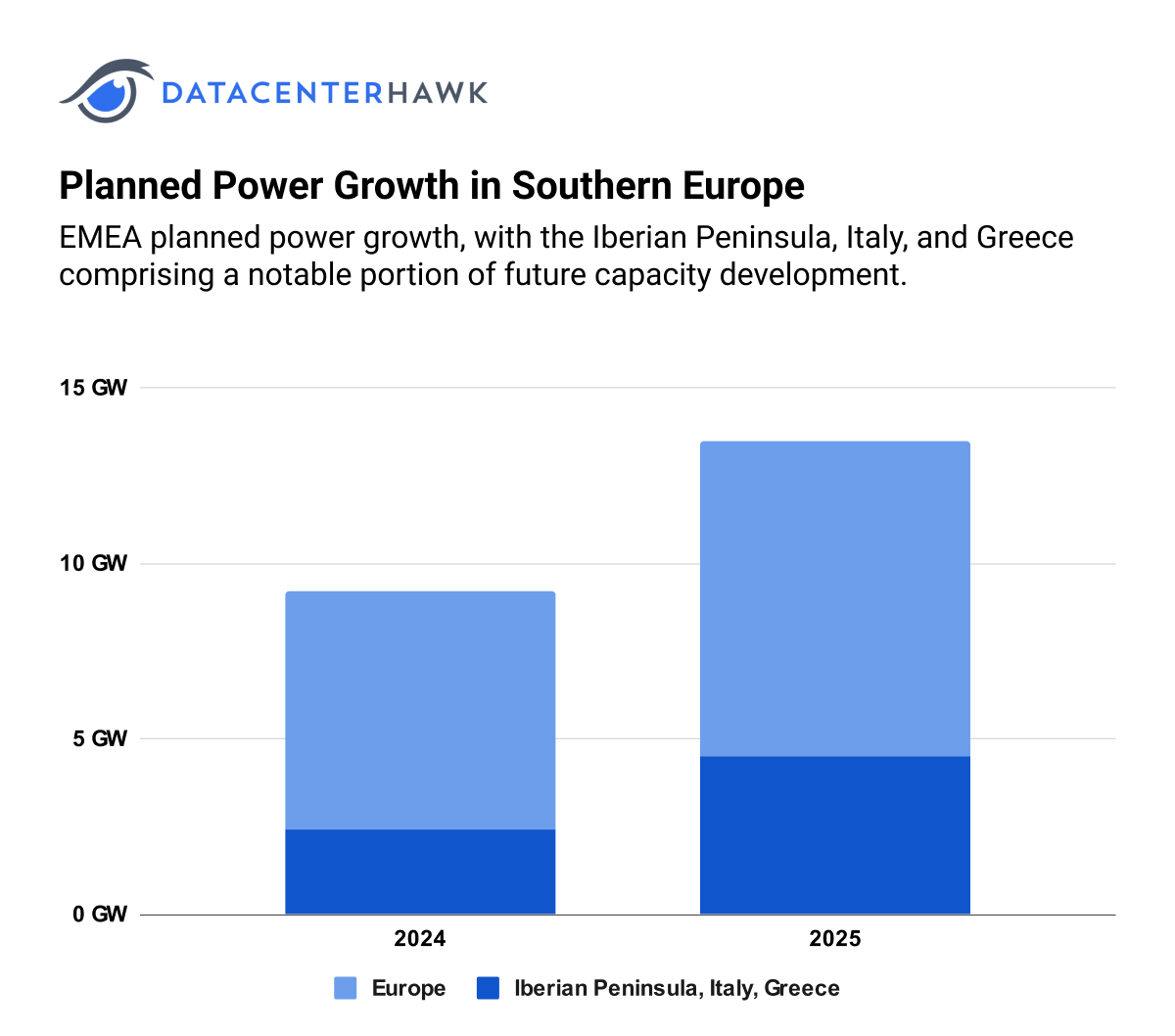

In the midst of moderate pull-back from some hyperscale companies, the data center market is bullish and continues to expand across nearly all regions of the continent. Demand remains strong, and investment in infrastructure is at its peak. We are seeing significant pipeline activity in key markets like Italy, Spain, France, and Greece, which are gaining traction thanks to factors such as artificial intelligence and their strategic geographical locations.

Planned Power Growth in Southern Europe

Spain, with its easy access to renewable energy sources and a robust fiber optic infrastructure, continues to be an attractive market for new investments. Italy, particularly Milan, is located in the heart of Europe, with excellent connectivity to France, Switzerland, Austria, and Germany, further cementing its importance in the data center ecosystem. France, with the recent AI summit held by President Macron, has attracted digital investments from all over the world. Greece, on the other hand, stands out as a gateway between Europe, Asia, and Africa, especially given the growing data traffic between Eastern Europe and the rest of the continent.

Notable Trends & Markets

Italy: Investments and Infrastructure Growth

Italy’s data center landscape is thriving with notable investments and new developments in Q1 2025.

- Swisscom’s €8 billion acquisition of Vodafone Italy merges the two entities into the country’s second-largest telecom provider.

- Microsoft and AWS are significantly enhancing their presence, with Microsoft investing €4.3 billion and AWS €1.2 billion for cloud expansion.

- Digital Realty is establishing a 35.2 MW data center in Rome, focusing on interconnection and subsea cables.

- VIRTUS Data Centres is expanding in Milan with its first Italian facility, a 70MW campus scheduled to begin construction in Q2 2025.

- Additionally, the Unitirreno subsea cable project, with a 480 Tbps capacity, will increase Italy’s connectivity between Genoa, Rome, and Mazara del Vallo, fortifying its strategic importance in Mediterranean digital infrastructure.

France: AI finds datacenter opportunities in nuclear-powered France

France's nuclear-powered energy infrastructure is proving to be a significant advantage in the development of AI-focused datacenters. With its commitment to low-carbon energy, France is attracting substantial investments in AI infrastructure across the country. Paris and Marseille have traditionally been the main hubs, but the arrival of AI has spurred growth in other regions.

- Data4 plans to build an AI data center with a capacity of more than 1GW

- Dataone in Grenoble is building an 80MW IT datacenter campus (South East).

- Sesterce, a GPU cloud provider, committed to creating 1.5GW of compute power in France. Their ambitious plans include adding 600MW of capacity across two data centers in Grand Est by 2028, with a goal of reaching 1.2GW and over one million GPUs by 2030.

The rise of neoclouds, which are building their own datacenters away from traditional hubs, is also a notable trend.

The Netherlands: Expansion outside of Amsterdam

The Dutch data center landscape sees expansion with new facilities planned in North Holland, including a 10MW facility in Haarlem for Iron Mountain and NorthC is expanding capacity with an additional 11 MW of IT load capacity made available across its datacenters in Almere, Rotterdam, Aalsmeer, and Eindhoven. The lack of suitable locations is forcing operators to expand in regions like Rotterdam, The Hague, Almere, Lelystad, and Groningen.

Looking forward

The outlook for the European data center market is overwhelmingly positive. Despite some strategic pauses from hyperscale companies, the sector continues to grow at an impressive pace, driven by artificial intelligence, cloud demand, and regional advantages. Southern Europe is quickly emerging as a digital powerhouse, with Spain, Italy, France, and Greece leading the charge thanks to strong infrastructure, energy availability, and strategic positioning. The coming years are expected to bring even more large-scale projects, deeper international connectivity, and new hubs beyond traditional markets—setting the stage for a dynamic and diversified data center ecosystem across the continent.

Asia-Pacific Data Center Markets

Amidst heightened economic uncertainty, APAC data center markets continue to defy global headwinds with remarkable resilience. Since Q4'24, the APAC region size has grown by 10%, from 7.7GW to 8.5GW. Operators and hyperscalers alike are pressing forward with aggressive expansion strategies - topping out new facilities, acquiring land across key markets, and investing in next-generation infrastructure. From sustainable upgrades in mature markets to AI-driven builds and rapid land banking across the region, activity remains strong, signaling unwavering confidence in APAC’s long-term digital growth trajectory.

Notable Trends & Markets

Land Banking Accelerates as Data Center Operators and Hyperscale Expansion Intensifies in APAC

Hyperscalers and data center operators are intensifying their land banking strategies across APAC, highlighting the region's strategic importance. In the past 3 months, at least US$36 billion has been announced in investments across the APAC markets, these funds are mostly used for site acquisitions and expanding data center builds. AWS, Microsoft, Google, and Alibaba have all made notable moves - from launching new cloud regions to securing vast land parcels across Malaysia, Thailand, and Australia. These acquisitions not only reflect rising cloud adoption but also underscore a push to localize infrastructure and reduce latency. The competition has also extended to regional operators like GreenSquareDC, which is building future-ready campuses in key markets across Australia.

Sustainability Initiatives Take Root in Asia's Mature Data Center Markets

In developed APAC markets, sustainability is no longer a differentiator but a baseline expectation. Major operators are deploying solar farms, green bonds, and low-carbon materials to align with stricter environmental goals. AWS is embedding low-carbon concrete into facilities in Japan, where it plans to invest over US$15 billion. Meanwhile, Meta's 150MW floating solar project in Singapore and Equinix's S$500 million green bond are emblematic of a broader trend: integrating renewable energy and energy-efficient designs into long-term infrastructure strategies.

AI Workloads Drive the Next Generation of Data Center investment

Demand for AI training and inference capabilities is steering a new wave of facility development across the region. Currently, capacity that is under development (UC+Planned) is greater than anything APAC has ever seen, with a total of 14.7GW of capacity in the works, this is up from 11.9GW last quarter. Operators are racing to build AI-optimized infrastructure, with projects like STT Bangkok 2 and ResetData's AI-F1 factory in Melbourne catering to high-density, GPU-heavy deployments. In Malaysia, Currenc Group and Treasure Global Inc. are betting big on AI-specific campuses, backed by new investment funds and phased rollout strategies. These developments reflect a shift from general-purpose cloud to specialized, performance-driven environments built to support the AI revolution.

Looking Forward

The APAC data center market is demonstrating strong conviction despite broader economic uncertainty, as evidenced by the robust development pipeline across the region. Looking ahead, activity is expected to remain high, with both hyperscalers and colocation providers pushing forward with new builds, land acquisitions, and infrastructure upgrades. This sustained momentum reflects long-term confidence in the region's digital growth, underpinned by rising AI workloads, increasing demand for localized infrastructure, and strategic moves into emerging secondary and tertiary markets.