By David Liggitt · 11/5/2015

Tracking the data center market is challenging. For years, data center operators, investment firms, and brokerage companies have struggled to truly understand market size, vacancy, and absorption as it relates to data centers.

Data center operators and investors gain significant value in knowing a market's size and comparing it to another as they evaluate opportunities with end users. But these four challenges prohibit industry professionals from getting a clear picture of data center markets:

- Power vs. Space – The traditional real estate market measures market size in square feet. While space plays a part in every data center infrastructure decision (i.e. do-it-yourself, colocation, and even cloud), the metric driving the data center industry is power as measured in megawatts. Looking at a data center market size based solely on square footage is an old practice that should be abandoned

- Defining the market – In the past, most have split the colocation market into retail and wholesale terms. Retail colocation is defined as data center providers that offer smaller, shared infrastructure to users that might add managed services as well. Wholesale colocation referred to the leasing of dedicated infrastructure in a shared environment. But the market has merged in the last two years, as larger providers are offering smaller footprints and smaller providers are chasing larger transactions

- Double Counting – The data center business is incestuous, as many smaller providers lease space from larger data center providers (the recent Equinix lease with T5 Data Centers in Plano, TX is a good example). Market numbers are often inflated when that power is counted twice, presenting an inaccurate view of market size

- Different Sources – Individuals analyze and size the data center market in different ways, which results in arbitrary numbers. This bad data leads to confusion when comparing one market size to another. An accurate portrayal of market size is only possible when those compiling the data do it in a standardized manner

Introducing a New Solution to These Challenges

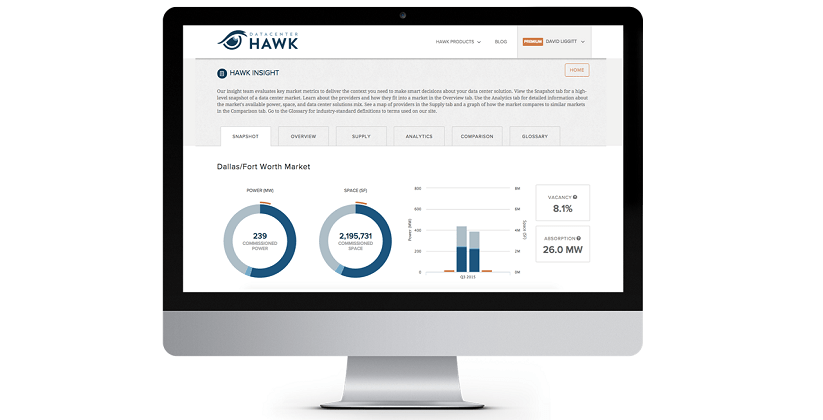

At datacenterHawk, we create products that make life easier for data center professionals. I'm proud to announce the recent release of our newest product, Hawk Insight, which is the combination of our extensive research on North America's top data center markets and real-time analytics. We address each of the challenges above through our methodology as we evaluate each market.

Hawk Insight enables our subscribers to evaluate key industry-standard metrics such as power, space, vacancy and absorption in the top ten data center markets in America. We add in-depth research notes on not only the colocation and cloud providers in each market, but the economic drivers, fiber infrastructure, and disaster risks that affect the region. Hawk Insight is an invaluable tool to get the context you need to make smart decisions about your data center solution.

If you're an IT Director migrating your on-site data center into either a colocation or cloud solution, then Hawk Insight can instantly give you the raw data and analysis you need make a strong business case to your CIO. If you're a data center broker, Hawk Insight enables you to quickly and easily interpret data center market research and details in an industry-leading format.