By Luke Smith · 7/22/2025

North American Data Center Markets

North American data center markets maintained stable demand throughout 2Q 2025, with activity driven primarily by AI and hyperscale cloud companies navigating strategic deployment cycles. Data center providers demonstrated unwavering confidence in long-term growth prospects, continuing aggressive land-banking strategies that resulted in a 6% increase in planned data center power capacity. This strategic positioning reflects industry conviction that current market conditions represent a temporary recalibration rather than a fundamental demand shift, with operators preparing infrastructure to capitalize on anticipated acceleration in the second half of 2025.

Notable Trends & Markets

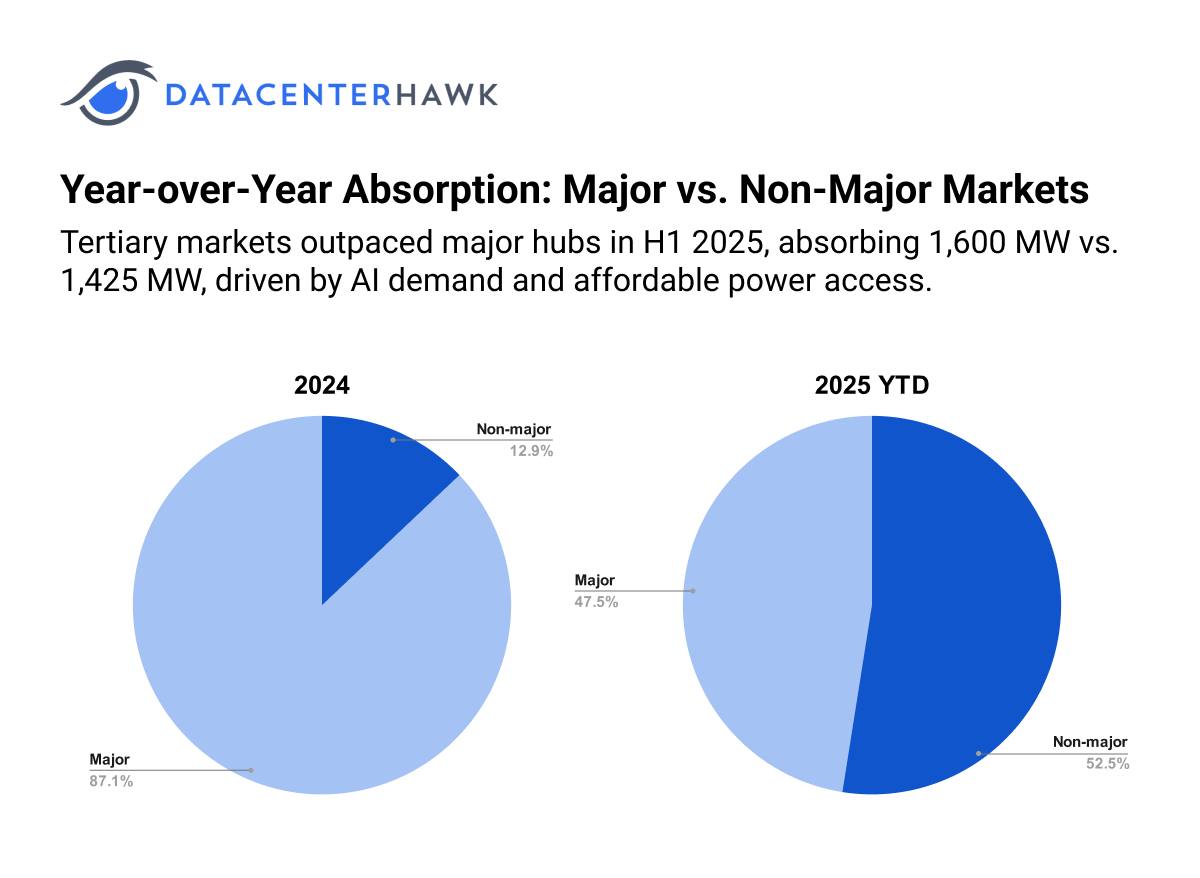

Non-Major Markets Outpace Traditional Hubs in Absorption Activity

Year-over-Year Absorption: Major vs. Non-Major Markets

A shift has occured through the first half of the year as non-major markets absorbed more capacity than established data center hubs, with tertiary markets capturing approximately 1,600 MW compared to 1,425 MW in traditional major markets. This trend, propelled by AI demand in previously overlooked regions, represents a fundamental rebalancing of North American data center geography. The economics of AI deployment—where proximity to major metropolitan areas is less critical than access to affordable power and land—are driving hyperscalers and cloud providers to explore markets that were previously considered secondary or tertiary. This geographic diversification is creating new opportunities for developers and communities while challenging traditional assumptions about data center market hierarchies.

Policy Backlash Emerges as Markets Grapple with Rapid Growth

The rapid expansion of data center activity has triggered a wave of policy responses across multiple markets, with local governments enacting moratoriums or removing tax incentives in response to infrastructure strain and community concerns. This regulatory pushback represents a new dynamic in the North American data center landscape, where previously welcoming jurisdictions are reassessing the balance between economic benefits and infrastructure capacity. The policy shifts are forcing developers to engage more strategically with local communities and government officials, while also accelerating the search for markets with more stable regulatory environments and greater infrastructure capacity to support continued growth.

AI Inference Nodes Fill Remaining Inventory Through Sub-10 MW Deployments

Data center providers are successfully leveraging AI inference workloads to optimize their remaining vacant space, with sub-10 MW deployments becoming an increasingly popular solution for filling inventory gaps. This trend reflects the growing sophistication of AI deployment strategies, where inference nodes require different infrastructure specifications than large-scale training facilities. The flexibility of these smaller deployments allows providers to maximize utilization rates while serving the growing demand for distributed AI processing capabilities. This strategic approach to inventory management is proving particularly effective in markets where larger hyperscale deployments may not be immediately available.

Looking Forward

North American data center markets are positioned for a significant uptick in demand during the second half of 2025, driven by multiple converging factors including large lease commitments approaching finalization, hyperscale fiscal budget renewals, and broader demand acceleration trends. The market's current positioning—with substantial planned capacity increases and strategic geographic diversification—suggests that providers are well-prepared to capitalize on this anticipated demand surge. The successful navigation of policy challenges and optimization of smaller AI inference deployments will likely determine which markets and providers are best positioned to capture the next wave of growth in the evolving North American data center landscape.

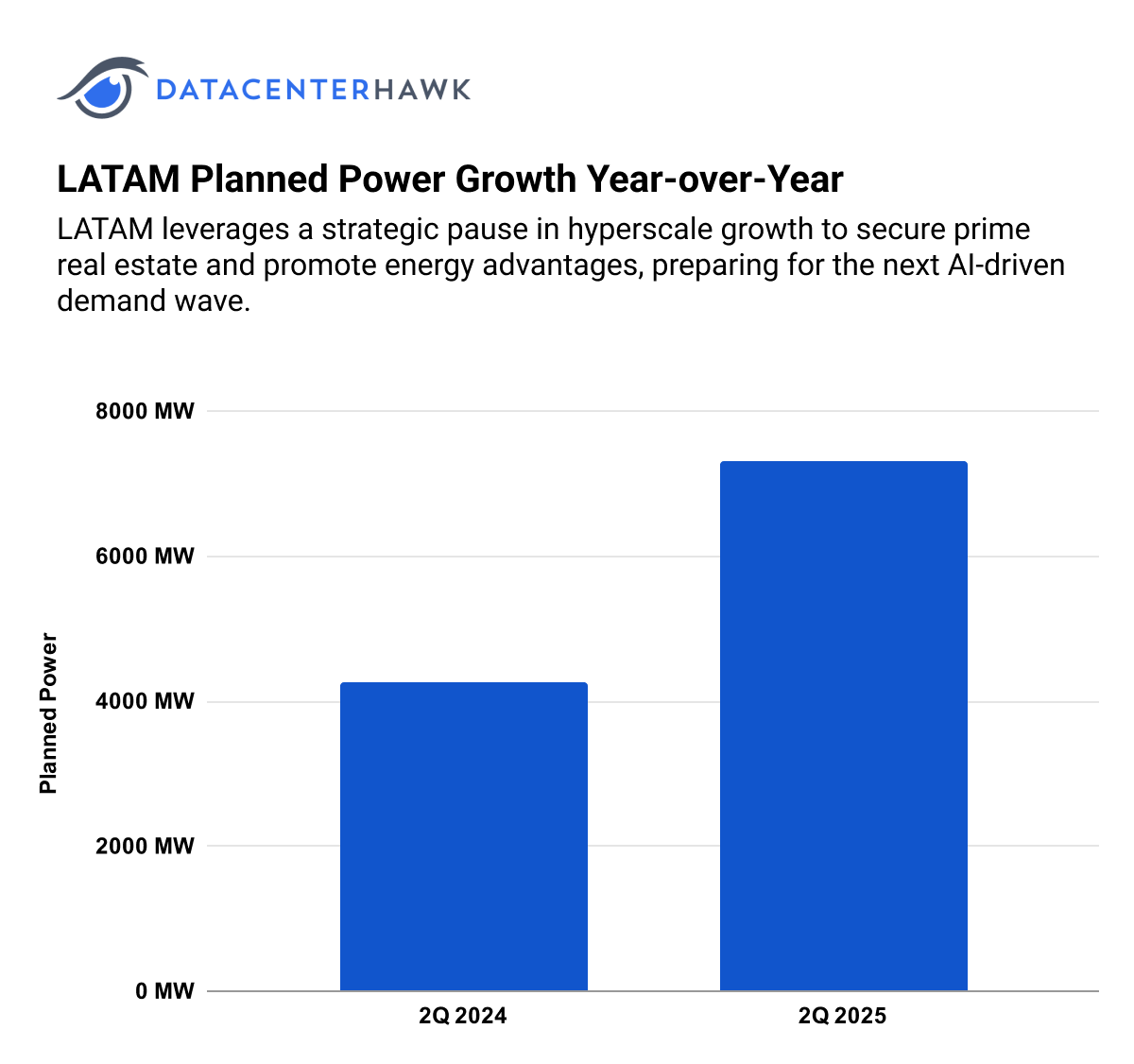

Latin American Data Center Markets

As regional hyperscale growth in parts of Latin America experiences a strategic pause, driven by renewed focus on U.S. domestic deployments, countries, markets, and providers across the region are actively positioning themselves as ideal destinations for future AI infrastructure. This has created an opportunity for regional players to secure prime real estate with power guarantees, while governments increasingly promote their competitive advantages in affordable land and energy abundance. The result is a market preparing for the next wave of AI-driven demand with unprecedented strategic positioning.

LATAM Planned Power Growth Year-over-Year

Notable Trends & Markets

AI Cities and Infrastructure Preparation Drive Unprecedented Planning Activity

The anticipation of future AI-driven hyperscale demand has triggered a remarkable wave of strategic positioning across Latin America. Brazil leads this charge with ambitious "AI City" initiatives in Porto Alegre and Rio de Janeiro, while Argentina, Chile, and Mexico are increasingly vocal in promoting their own competitive advantages. This forward-looking approach is reflected in dramatic planning metrics, with planned capacity in the region increasing by over 500 MW in 2Q alone. The total planned capacity now stands at three times the level of commissioned capacity, with São Paulo maintaining its leadership position with over 1.6 of planned capacity, followed by significant growth corridors in Querétaro, Rio de Janeiro, Bogotá, and Fortaleza.

Power Migration Reshapes Traditional Market Hierarchies

Power access constraints are fundamentally altering the geography of Latin American data center development, forcing operators to abandon traditional hubs in favor of regions with superior grid connectivity. In Mexico, operators are expanding north of Querétaro to secure lower interconnection costs and reduced transmission congestion, while Brazil's new development initiatives are spreading toward the Campinas region, away from São Paulo's overloaded infrastructure. The economics of power access have become so challenging that some industrial parks are charging between US$800 and US$1,000 per kVA as part of power assurance packages, while operators frequently find themselves co-financing substations or transmission lines to secure grid access.

Chinese Hyperscale Users Quietly Establish Regional Foothold

While traditional hyperscalers focus on domestic U.S. deployments, Chinese cloud providers—including Alibaba, Tencent, ByteDance, and Huawei—are expanding their Latin American presence through strategic 1–5 MW deployments. This measured approach contrasts sharply with one notable exception actively pursuing a 200 MW+ opportunity across Brazil and Mexico. This quiet expansion represents a significant shift in the regional competitive landscape, with Chinese providers positioning themselves to capture market share as demand conditions evolve.

Looking Forward

Latin America's data center landscape is entering a critical preparation phase, with regional markets balancing unique local challenges against significant growth potential. The rapid expansion of planned capacity, increased focus on energy availability, and growing government engagement are setting the stage for a more mature and scalable digital infrastructure ecosystem. As countries navigate regulatory shifts, infrastructure constraints, and economic volatility, their ability to address structural bottlenecks while capitalizing on AI momentum will define the region's role in the global data center arena when the next investment cycle accelerates.

European Data Center Markets

EMEA data center markets exhibited stable yet subdued demand patterns throughout 2Q 2025, mirroring global trends as AI and hyperscale cloud companies continued their measured approach to strategic deployments. Despite the tempered absorption activity, data center providers across the region maintained their aggressive land-banking strategies, demonstrating persistent confidence in long-term growth trajectories. This forward-looking investment stance reflects broader industry sentiment that current market conditions represent a strategic pause rather than a fundamental shift in demand dynamics, with operators positioning themselves to capture anticipated growth acceleration in the latter half of 2025.

Notable Trends & Markets

Geographic Diversification Accelerates Beyond Capital Cities

A pronounced shift toward geographic diversification emerged across EMEA markets in 2Q 2025, with demand increasingly flowing beyond traditional capital city strongholds to secondary and tertiary locations. This trend manifested distinctly across the UK, Spain, the Netherlands, and Germany, where data center deployments expanded into previously underutilized regions. The driving forces behind this geographic rebalancing include cost optimization pressures, infrastructure capacity constraints in major metropolitan areas, and the recognition that AI workloads can operate effectively outside premium urban locations. This decentralization is creating new market opportunities while alleviating pressure on established data center hubs that have reached infrastructure saturation points.

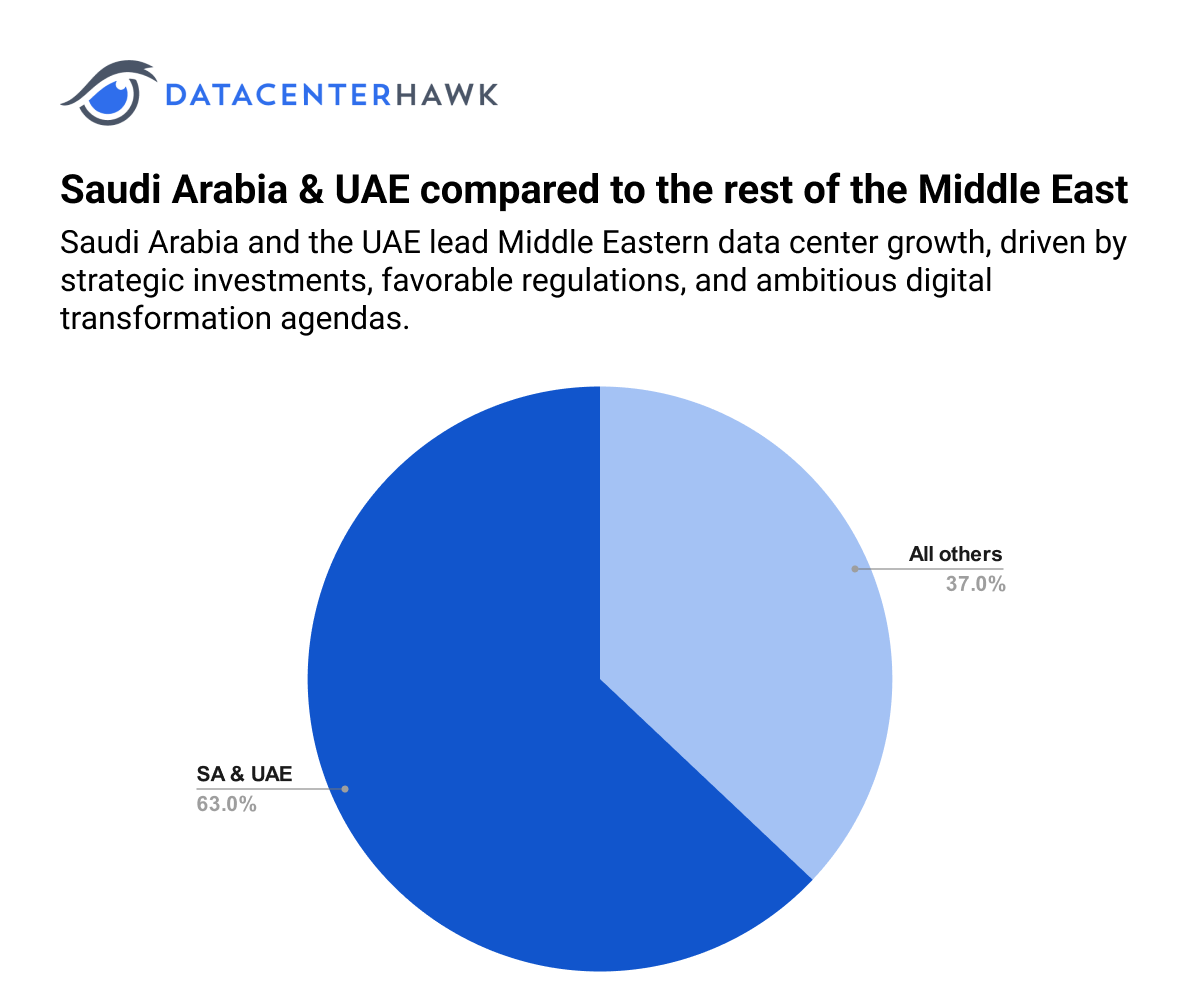

Middle East Leadership Consolidates in Gulf States

Saudi Arabia and the emerged as the dominant forces in Middle Eastern data center development during 2Q 2025, leading both current online capacity and future planned deployments across the region. This leadership position reflects sustained government investment in digital infrastructure as part of broader economic diversification strategies, combined with favorable regulatory environments and competitive power costs. The Gulf states' strategic positioning as bridges between European, Asian, and African markets is attracting significant hyperscale investment, while their ambitious national digital transformation agendas are driving substantial domestic demand for data center capacity.

Saudi Arabia & UAE compared to the rest of the Middle East

Regulatory Competition Intensifies Through AI Policy Frameworks

European countries are increasingly leveraging AI regulatory frameworks as competitive tools to attract data center deployments, with multiple nations implementing policies designed to position themselves as preferred destinations for AI infrastructure. This regulatory competition represents a sophisticated evolution in government approaches to data center attraction, moving beyond traditional tax incentives to comprehensive AI governance frameworks that provide operational certainty for hyperscale deployments. The policy initiatives are creating a complex landscape where regulatory clarity and AI-friendly frameworks are becoming key differentiators in location selection decisions.

Looking Forward

EMEA data center markets are positioned for significant demand acceleration during the second half of 2025, driven by converging factors including substantial lease commitments nearing finalization, hyperscale budget renewals, and broader demand momentum as countries crystallize their AI deployment strategies. The region's strategic geographic diversification and regulatory innovation initiatives have created a foundation for sustained growth, while the Middle East's infrastructure leadership and Europe's AI policy frameworks are establishing new competitive dynamics that will likely define market development patterns through the remainder of 2025 and beyond.

Asia-Pacific Data Center Markets

APAC data center markets experienced robust activity throughout 2Q 2025, with AI demand serving as the primary catalyst for substantial capacity absorption across most regional markets. Unlike the more measured approaches observed in North America and EMEA, APAC markets demonstrated pronounced enthusiasm for AI infrastructure deployments, driven by aggressive digital transformation initiatives and strategic positioning for next-generation computing workloads. This regional dynamism reflects the convergence of strong government support, abundant investment capital, and strategic geographic advantages that are positioning APAC as a critical hub for global AI infrastructure development.

Notable Trends & Markets

Auckland Emerges as South Pacific Hyperscale Gateway

Auckland has rapidly established itself as an attractive South Pacific hyperscale hub during 2Q 2025, leveraging its strategic geographic position and favorable regulatory environment to capture significant hyperscale interest. The city's emergence as a regional data center destination reflects its unique value proposition as a gateway to both Asian and Pacific markets, combined with competitive power costs and stable political infrastructure. Auckland's rise demonstrates how secondary markets can capitalize on strategic positioning and supportive policy frameworks to compete effectively with established regional hubs, while its South Pacific location offers latency advantages for serving distributed Pacific Island markets and transpacific connectivity requirements.

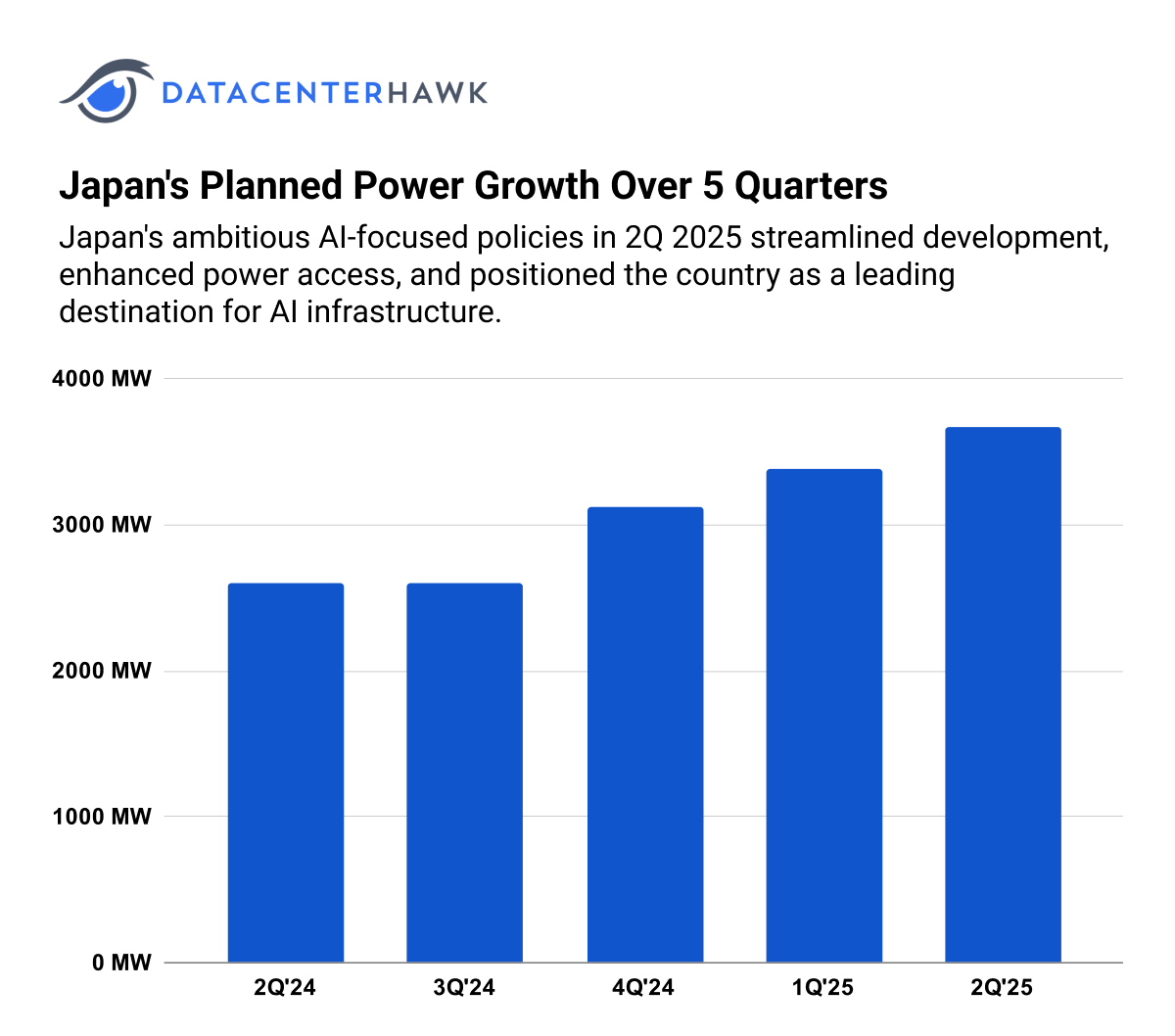

Japan Accelerates AI Infrastructure Through Legislative Innovation

Japan implemented comprehensive legislative frameworks in 2Q 2025 designed to attract AI growth and stimulate data center development across the country, representing one of the most ambitious national AI infrastructure strategies in the region. These policy initiatives encompass streamlined permitting processes, enhanced power grid access, and targeted incentives for AI-focused data center deployments, while addressing traditional barriers that have limited large-scale infrastructure development. Japan's legislative approach signals a strategic commitment to positioning the country as a preferred destination for AI infrastructure, leveraging its technological expertise and geographic advantages to compete more effectively with regional neighbors for hyperscale deployments.

Japan's Planned Power Growth Over 5 Quarters

Investment Capital Surge Transforms Regional Development Landscape

A staggering influx of investment and partnership capital flooded APAC data center markets during 2Q 2025, fundamentally altering the development landscape across the region. This capital surge encompasses both domestic investment from regional technology giants and international funding from global infrastructure investors seeking exposure to APAC's AI growth trajectory. The scale of investment activity is enabling accelerated development timelines and supporting increasingly ambitious project scopes, while creating new partnerships between traditional data center operators and emerging technology companies focused on AI infrastructure requirements.

Looking Forward

APAC data center markets face a paradoxical outlook for the remainder of 2025, characterized by exceptionally high demand across the region, coupled with anticipated slow growth due to power delivery bottlenecks and infrastructure capacity constraints. While market appetite for data center capacity remains robust, the substantial power requirements of AI workloads are creating supply-side challenges that will likely moderate growth rates despite strong underlying demand. This dynamic suggests that markets with superior power infrastructure and grid capacity will capture disproportionate growth, while regions struggling with power delivery limitations may experience delays in realizing their full market potential despite abundant investment interest and regulatory support.